股票均线策略

创建于: 2020-12-14 13:51:41,

更新于:

2023-11-29 21:36:31

2

2

2412

2412

股票均线策略

趋势策略中最简单的策略就是均线策略了,通过上一篇文章中我们探讨一个股票策略的几点特殊之处,并实现了一个经典策略。再来实现一个双均线策略就十分简单了。我们把之前的「股票DualThrust策略」中的策略逻辑等相关内容剔除,就拿到了一个股票策略的基本结构。这个程序结构可以复用于我们的双均线策略。其实就是把双均线的交易逻辑、数据处理等写进去就可以了,趋势策略基本都可以这样复用代码。

程序结构框架

剔除了之前策略交易逻辑后剩下的程序结构,这个程序还不能直接使用。

var Ids = [] // ["600519.SH"]

var _Symbols = []

var STATE_IDLE = 0

var STATE_LONG = 1

var SlideTick = 2

var StatusMsg = ""

var _Chart = null

var _ArrChart = []

var Interval = 1000

var ArrStateStr = ["空闲", "多仓"]

function newDate() {

var timezone = 8

var offset_GMT = new Date().getTimezoneOffset()

var nowDate = new Date().getTime()

var targetDate = new Date(nowDate + offset_GMT * 60 * 1000 + timezone * 60 * 60 * 1000)

return targetDate

}

function GetPosition(e, contractTypeName) {

var allAmount = 0

var allProfit = 0

var allFrozen = 0

var posMargin = 0

var price = 0

var direction = null

positions = _C(e.GetPosition)

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType != contractTypeName) {

continue

}

if (positions[i].Type == PD_LONG) {

posMargin = positions[i].MarginLevel

allAmount += positions[i].Amount

allProfit += positions[i].Profit

allFrozen += positions[i].FrozenAmount

price = positions[i].Price

direction = positions[i].Type

}

}

if (allAmount === 0) {

return null

}

return {

MarginLevel: posMargin,

FrozenAmount: allFrozen,

Price: price,

Amount: allAmount,

Profit: allProfit,

Type: direction,

ContractType: contractTypeName,

CanCoverAmount: allAmount - allFrozen

}

}

function Buy(e, contractType, opAmount, insDetail) {

var initPosition = GetPosition(e, contractType)

var isFirst = true

var initAmount = initPosition ? initPosition.Amount : 0

var positionNow = initPosition

if(opAmount % insDetail.LotSize != 0) {

throw "每手数量不匹配"

}

while (true) {

var needOpen = opAmount

if (isFirst) {

isFirst = false

} else {

Sleep(Interval*20)

positionNow = GetPosition(e, contractType)

if (positionNow) {

needOpen = opAmount - (positionNow.Amount - initAmount)

}

Log("positionNow:", positionNow, "needOpen:", needOpen)// 测试

}

if (needOpen < insDetail.LotSize || needOpen % insDetail.LotSize != 0) {

break

}

var depth = _C(e.GetDepth)

// 需要检测是否涨跌停

var amount = needOpen

e.SetDirection("buy")

var orderId = e.Buy(depth.Asks[0].Price + (insDetail.PriceSpread * SlideTick), amount, contractType, 'Ask', depth.Asks[0])

// CancelPendingOrders

while (true) {

Sleep(Interval*20)

var orders = _C(e.GetOrders)

if (orders.length === 0) {

break

}

for (var j = 0; j < orders.length; j++) {

e.CancelOrder(orders[j].Id)

if (j < (orders.length - 1)) {

Sleep(Interval*20)

}

}

}

}

var ret = null

if (!positionNow) {

return ret

}

ret = positionNow

return ret

}

function Sell(e, contractType, lots, insDetail) {

var initAmount = 0

var firstLoop = true

if(lots % insDetail.LotSize != 0) {

throw "每手数量不匹配"

}

while (true) {

var n = 0

var total = 0

var positions = _C(e.GetPosition)

var nowAmount = 0

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType != contractType) {

continue

}

nowAmount += positions[i].Amount

}

if (firstLoop) {

initAmount = nowAmount

firstLoop = false

}

var amountChange = initAmount - nowAmount

if (typeof(lots) == 'number' && amountChange >= lots) {

break

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType != contractType) {

continue

}

var amount = positions[i].Amount

var depth

var opAmount = 0

var opPrice = 0

if (positions[i].Type == PD_LONG) {

depth = _C(e.GetDepth)

// 需要检测是否涨跌停

opAmount = amount

opPrice = depth.Bids[0].Price - (insDetail.PriceSpread * SlideTick)

}

if (typeof(lots) === 'number') {

opAmount = Math.min(opAmount, lots - (initAmount - nowAmount))

}

if (opAmount > 0) {

if (positions[i].Type == PD_LONG) {

e.SetDirection("closebuy")

e.Sell(opPrice, opAmount, contractType, "平仓", 'Bid', depth.Bids[0])

}

n++

}

// break to check always

if (typeof(lots) === 'number') {

break

}

}

if (n === 0) {

break

}

while (true) {

Sleep(Interval*20)

var orders = _C(e.GetOrders)

if (orders.length === 0) {

break

}

for (var j = 0; j < orders.length; j++) {

e.CancelOrder(orders[j].Id)

if (j < (orders.length - 1)) {

Sleep(Interval*20)

}

}

}

}

}

function IsTrading() {

// 使用 newDate() 代替 new Date() 因为服务器时区问题

var now = newDate()

var day = now.getDay()

var hour = now.getHours()

var minute = now.getMinutes()

StatusMsg = "非交易时段"

if (day === 0 || day === 6) {

return false

}

if((hour == 9 && minute >= 30) || (hour == 11 && minute < 30) || (hour > 9 && hour < 11)) {

// 9:30-11:30

StatusMsg = "交易时段"

return true

} else if (hour >= 13 && hour < 15) {

// 13:00-15:00

StatusMsg = "交易时段"

return true

}

return false

}

function init () {

Ids = JSON.parse(StrIds)

for (var i = 0 ; i < Ids.length ; i++) {

_Symbols[i] = {}

_Symbols[i].ContractTypeName = Ids[i]

_Symbols[i].State = STATE_IDLE

_Symbols[i].ChartIndex = i

_Symbols[i].Status = ""

_Symbols[i].Pos = null

_Symbols[i].ChartCfg = {

// 图表对象

}

_ArrChart.push(_Symbols[i].ChartCfg)

}

_Chart = Chart(_ArrChart)

_Chart.reset()

}

function Process (symbols) {

for (var i = 0 ; i < symbols.length ; i++) {

var contractTypeName = symbols[i].ContractTypeName

var insDetail = _C(exchange.SetContractType, contractTypeName)

symbols[i].InstrumentName = insDetail.InstrumentName

// 判断是不是交易状态

if (!insDetail.IsTrading || !IsTrading()) {

continue

}

var depth = exchange.GetDepth()

if (!depth || depth.Bids[0].Amount == 0 || depth.Asks[0].Amount == 0) {

// 标记涨跌停

symbols[i].Status = "涨跌停"

continue

}

symbols[i].Status = "正常交易"

// 检测持仓

var pos = GetPosition(exchange, contractTypeName)

symbols[i].Pos = pos

var posAmount = pos ? pos.Amount : 0

// 同步持仓状态

if (symbols[i].State == STATE_IDLE && posAmount > 0) {

symbols[i].State = STATE_LONG

} else if (symbols[i].State == STATE_LONG && posAmount == 0) {

symbols[i].State = STATE_IDLE

}

// 执行交易

// Buy(exchange, contractTypeName, AmountOP, ticker.Info)

// Sell(exchange, contractTypeName, AmountOP, ticker.Info)

}

}

function main(){

if(IsReset) {

LogReset(1)

}

SetErrorFilter("market not ready")

exchange.SetPrecision(3, 0)

if((!IsVirtual() && exchange.GetCurrency() != "STOCK" && exchange.GetName() != "Futures_Futu") ||

(IsVirtual() && exchange.GetCurrency() != "STOCK_CNY" && exchange.GetName() != "Futures_XTP")) {

Log("currency:", exchange.GetCurrency(), "name:", exchange.GetName())

throw "不支持"

}

while(true){

var tbl = {

"type" : "table",

"title": "信息",

"cols": [],

"rows": [],

}

for(var i = 0 ; i < _Symbols.length; i++) {

tbl.rows.push([])

}

var tblPos = {

"type" : "table",

"title" : "持仓",

"cols" : ["名称", "价格", "数量", "盈亏", "类型", "冻结数量", "可平量"],

"rows" : [],

}

for (var j = 0 ; j < _Symbols.length; j++) {

if(_Symbols[j].Pos) {

tblPos.rows.push([_Symbols[j].Pos.ContractType, _Symbols[j].Pos.Price, _Symbols[j].Pos.Amount, _Symbols[j].Pos.Profit, _Symbols[j].Pos.Type, _Symbols[j].Pos.FrozenAmount, _Symbols[j].Pos.CanCoverAmount])

}

}

LogStatus(_D(), StatusMsg, "\n`" + JSON.stringify([tbl, tblPos]) + "`")

Process(_Symbols)

Sleep(1000)

}

}

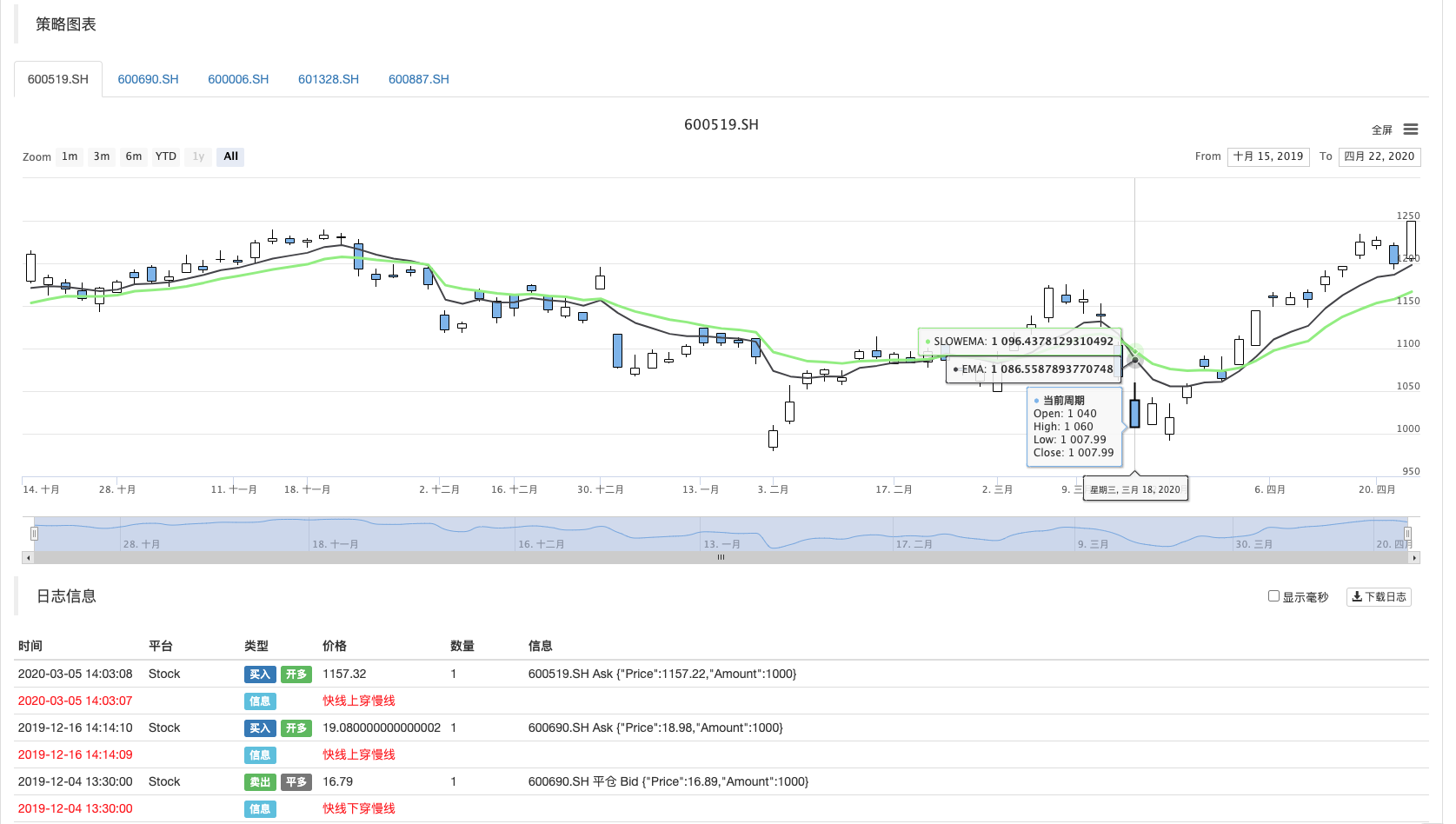

双均线策略

- 首先调整一下界面参数

添加上双均线需要的策略参数。

添加策略交易逻辑

// 计算指标数据 var ma = TA.EMA(r, MAPeriod) // 周期小的均线指标数据(快线) var slowMa = TA.EMA(r, SlowMAPeriod) // 周期大的均线指标数据(慢线) ... // 交易信号检测 if(symbols[i].State == STATE_IDLE && ma[ma.length - 2] > slowMa[slowMa.length - 2] && ma[ma.length - 3] < slowMa[slowMa.length - 3]) { Log("快线上穿慢线", "#FF0000") Buy(exchange, contractTypeName, Amount, ticker.Info) symbols[i].State = STATE_LONG } else if (symbols[i].State == STATE_LONG && ma[ma.length - 2] < slowMa[slowMa.length - 2] && ma[ma.length - 3] > slowMa[slowMa.length - 3]) { Log("快线下穿慢线", "#FF0000") Sell(exchange, contractTypeName, Amount, ticker.Info) symbols[i].State = STATE_IDLE }交易信号检测其实就是判断快线上穿、下穿慢线,这里使用的是倒数第二、第三根K线柱上对应的指标判断,因为最后一个指标数据是实时的,所以会有反复交叉分开的情况。

其它细节 因为这次策略用到了2根均线指标,我们需要在K线图表上把均线画出来,所以对画图部分的代码做了小小的调整。 对于策略状态栏显示的信息也需要略微调整,显示当前策略的均线指标、当前价格等数据。 最近优宽平台支持了股票回测,所以我们也要针对回测系统做一些兼容,策略中一些用到

IsVirtual()函数的地方就是为了回测系统做的兼容。

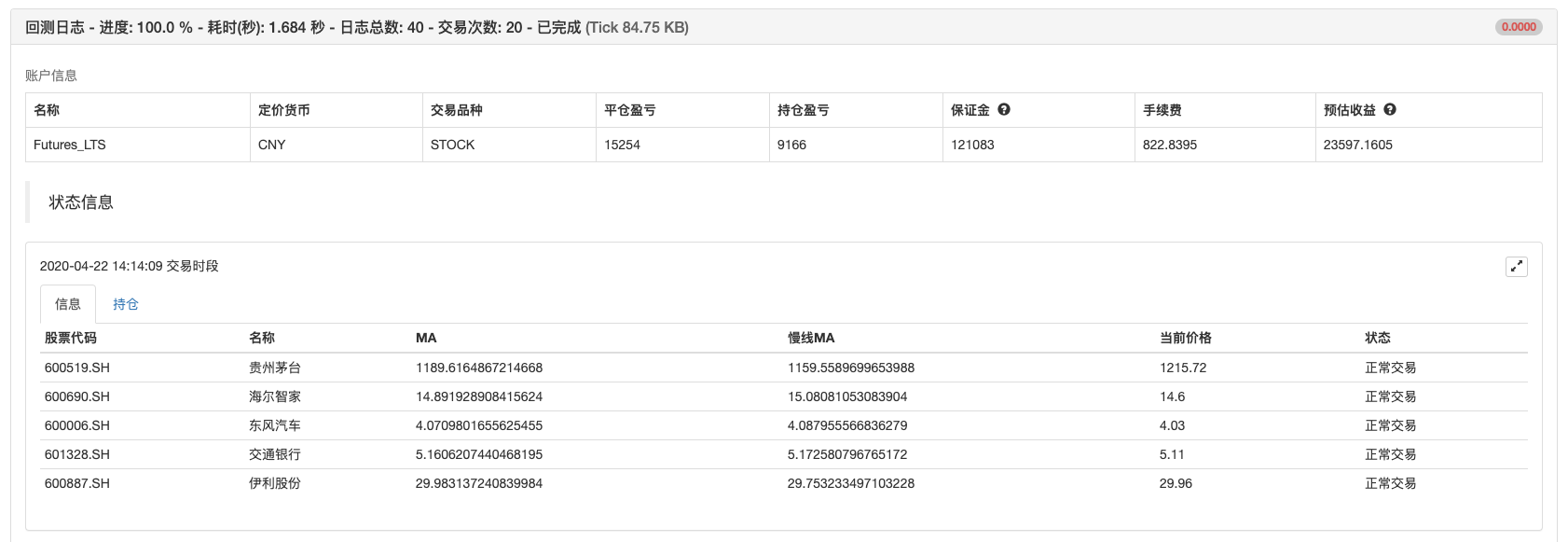

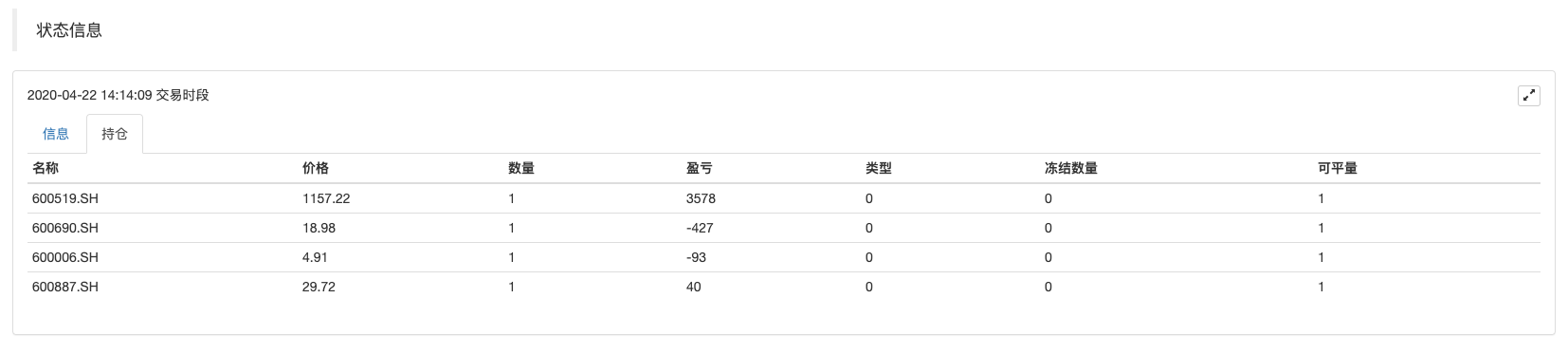

回测测试

回测仅仅是策略初步测试,所以不必太在意回测结果。所以我们随便选择几只股票,随便设置一些参数回测一下。

富途模拟盘

同样也可以挂一个富途模拟盘测试,优宽平台后续也会支持更多券商。

结尾

策略仅仅用于学习交流,交流策略设计思路,互相学习。 感谢阅读,感谢提出建议及意见。

相关推荐

- CTA策略之商品期货马丁普林格KST策略

- CTA策略之商品期货简易马丁格尔

- CTA策略之均价振幅ATR策略

- CTA策略之商品期货定时启停机器人

- JavaScript版本行情收集器

- CTA策略之钱德动量摆动(CMO)

- 全市场多品种CTA策略介绍

- 商品期货的OpenInterest和优宽回测撮合机制

- 股票网格策略

- 利用相对强弱RSI实现低买高卖 - 商品期货MY语言策略

- 港股量化之钱德动量摆动策略(CMO)

- 优宽股票实盘、模拟盘程序化交易实战--股票版DualThrust策略

- 港股美股量化交易指南(一)

- 给商品期货策略加上一个闹钟--策略中的定时设计

- 机器人微信消息推送实现方案

- 图解正反马丁格尔策略

- 商品期货移仓类库

- 筑底形态ZDZB策略

- 乖离率BIAS策略

- 简易波动EMV策略