Python版商品期货跨期布林对冲策略 (教学)

创建于: 2020-06-08 16:16:16,

更新于:

2023-11-30 20:37:25

0

0

3667

3667

Python版商品期货跨期布林对冲策略 (教学)

之前写的跨期策略,是需要手动输入开仓对冲差价、平仓对冲差价的。对于差价判断比较主观。本次文章,我们一起把之前的对冲策略魔改成使用BOLL指标进行对冲开平仓操作的策略。

class Hedge:

'对冲控制类'

def __init__(self, q, e, initAccount, symbolA, symbolB, maPeriod, atrRatio, opAmount):

self.q = q

self.initAccount = initAccount

self.status = 0

self.symbolA = symbolA

self.symbolB = symbolB

self.e = e

self.isBusy = False

self.maPeriod = maPeriod

self.atrRatio = atrRatio

self.opAmount = opAmount

self.records = []

self.preBarTime = 0

def poll(self):

if (self.isBusy or not exchange.IO("status")) or not ext.IsTrading(self.symbolA):

Sleep(1000)

return

insDetailA = exchange.SetContractType(self.symbolA)

if not insDetailA:

return

recordsA = exchange.GetRecords()

if not recordsA:

return

insDetailB = exchange.SetContractType(self.symbolB)

if not insDetailB:

return

recordsB = exchange.GetRecords()

if not recordsB:

return

# 计算差价K线

if recordsA[-1]["Time"] != recordsB[-1]["Time"]:

return

minL = min(len(recordsA), len(recordsB))

rA = recordsA.copy()

rB = recordsB.copy()

rA.reverse()

rB.reverse()

count = 0

arrDiff = []

for i in range(minL):

arrDiff.append(rB[i]["Close"] - rA[i]["Close"])

arrDiff.reverse()

if len(arrDiff) < self.maPeriod:

return

# 计算布林指标

boll = TA.BOLL(arrDiff, self.maPeriod, self.atrRatio)

ext.PlotLine("上轨", boll[0][-2], recordsA[-2]["Time"])

ext.PlotLine("中轨", boll[1][-2], recordsA[-2]["Time"])

ext.PlotLine("下轨", boll[2][-2], recordsA[-2]["Time"])

ext.PlotLine("收盘价差价", arrDiff[-2], recordsA[-2]["Time"])

LogStatus(_D(), "上轨:", boll[0][-1], "\n", "中轨:", boll[1][-1], "\n", "下轨:", boll[2][-1], "\n", "当前收盘差价:", arrDiff[-1])

action = 0

# 信号触发

if self.status == 0:

if arrDiff[-1] > boll[0][-1]:

Log("开仓 A买B卖", ",A最新价格:", recordsA[-1]["Close"], ",B最新价格:", recordsB[-1]["Close"], "#FF0000")

action = 2

# 加入图表标记

ext.PlotFlag(recordsA[-1]["Time"], "A买B卖", "正")

elif arrDiff[-1] < boll[2][-1]:

Log("开仓 A卖B买", ",A最新价格:", recordsA[-1]["Close"], ",B最新价格:", recordsB[-1]["Close"], "#FF0000")

action = 1

# 加入图表标记

ext.PlotFlag(recordsA[-1]["Time"], "A卖B买", "反")

elif self.status == 1 and arrDiff[-1] > boll[1][-1]:

Log("平仓 A买B卖", ",A最新价格:", recordsA[-1]["Close"], ",B最新价格:", recordsB[-1]["Close"], "#FF0000")

action = 2

# 加入图表标记

ext.PlotFlag(recordsA[-1]["Time"], "A买B卖", "反平")

elif self.status == 2 and arrDiff[-1] < boll[1][-1]:

Log("平仓 A卖B买", ",A最新价格:", recordsA[-1]["Close"], ",B最新价格:", recordsB[-1]["Close"], "#FF0000")

action = 1

# 加入图表标记

ext.PlotFlag(recordsA[-1]["Time"], "A卖B买", "正平")

# 执行具体指令

if action == 0:

return

self.isBusy = True

tasks = []

if action == 1:

tasks.append([self.symbolA, "sell" if self.status == 0 else "closebuy"])

tasks.append([self.symbolB, "buy" if self.status == 0 else "closesell"])

elif action == 2:

tasks.append([self.symbolA, "buy" if self.status == 0 else "closesell"])

tasks.append([self.symbolB, "sell" if self.status == 0 else "closebuy"])

def callBack(task, ret):

def callBack(task, ret):

self.isBusy = False

if task["action"] == "sell":

self.status = 2

elif task["action"] == "buy":

self.status = 1

else:

self.status = 0

account = _C(exchange.GetAccount)

LogProfit(account["Balance"] - self.initAccount["Balance"], account)

self.q.pushTask(self.e, tasks[1][0], tasks[1][1], self.opAmount, callBack)

self.q.pushTask(self.e, tasks[0][0], tasks[0][1], self.opAmount, callBack)

def main():

SetErrorFilter("ready|login|timeout")

Log("正在与交易服务器连接...")

while not exchange.IO("status"):

Sleep(1000)

Log("与交易服务器连接成功")

initAccount = _C(exchange.GetAccount)

Log(initAccount)

def callBack(task, ret):

Log(task["desc"], "成功" if ret else "失败")

q = ext.NewTaskQueue(callBack)

p = ext.NewPositionManager()

if CoverAll:

Log("开始平掉所有残余仓位...")

p.CoverAll()

Log("操作完成")

t = Hedge(q, exchange, initAccount, SA, SB, MAPeriod, ATRRatio, OpAmount)

while True:

q.poll()

t.poll()

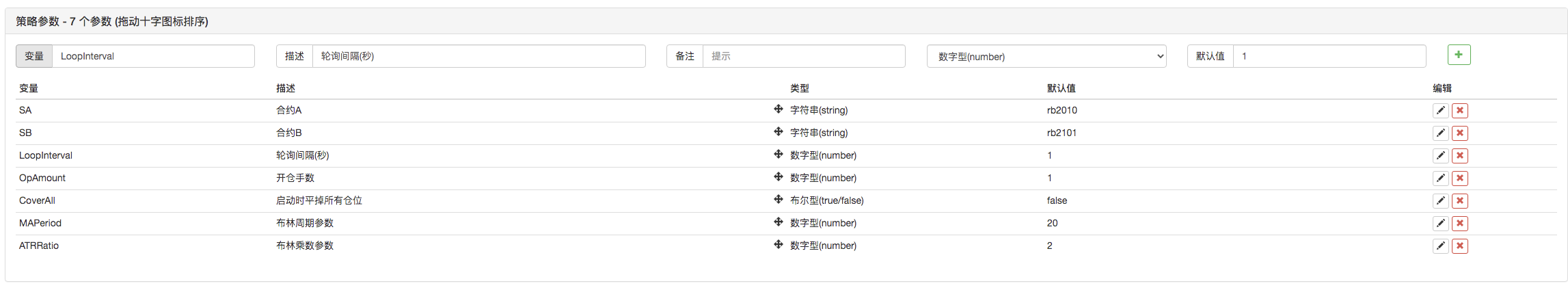

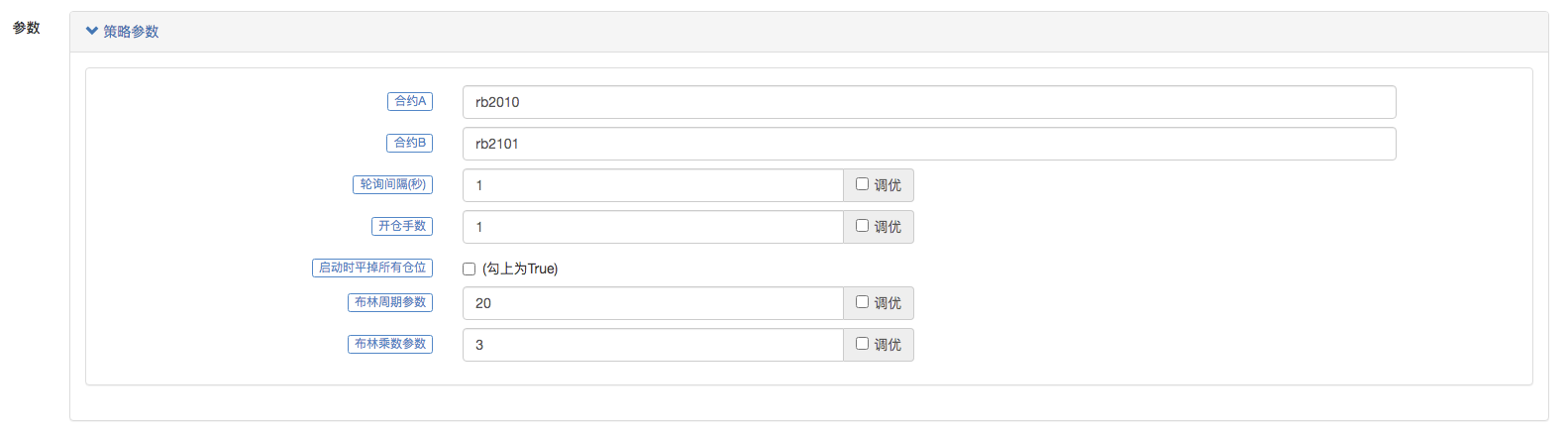

策略参数设置:

策略整体框架和Python版商品期货跨期对冲策略 (教学)基本一样,只是增加了对应的BOLL指标参数,策略运行时,获取两个合约的K线数据,然后计算差价,计算出一个差价数组,用作TA.BOLL函数的数据,计算布林线,当差价超过布林线上轨时正对冲,触碰下轨时反对冲。持仓时触碰布林中线平仓。

回测运行:

策略主要用于教学、学习参考。 完整策略:https://www.youquant.com/strategy/213826

相关推荐

- 港股量化之钱德动量摆动策略(CMO)

- 优宽股票实盘、模拟盘程序化交易实战--股票版DualThrust策略

- 港股美股量化交易指南(一)

- 给商品期货策略加上一个闹钟--策略中的定时设计

- 机器人微信消息推送实现方案

- 图解正反马丁格尔策略

- 商品期货移仓类库

- 筑底形态ZDZB策略

- 乖离率BIAS策略

- 简易波动EMV策略

- 基于优宽量化基本面数据的商品期现套利图表

- Python版商品期货跨期对冲策略

- Python版商品期货多品种均线策略

- 升级商品期货多品种海龟交易策略以及回测说明

- 鳄鱼线交易系统Python版

- 基于新型相对强弱指数在日内策略中的使用

- 基于Alpha101语法开发的增强分析工具

- 商品期货R-Breaker策略

- 商品期货多品种均线策略

- 商品期货量能足迹图footprint chart分析与实现