Python版商品期货跨期对冲策略

创建于: 2020-06-01 17:23:29,

更新于:

2023-11-30 20:39:38

2

2

2172

2172

Python版商品期货跨期对冲策略

移植自JavaScript版本的「商品期货跨期对冲 - 百行代码实现」,本策略为简单的教学策略,意图展示Python语言的商品期货策略设计。主要用于学习策略编写、参考设计思路。

class Hedge:

'对冲控制类'

def __init__(self, q, e, initAccount, symbolA, symbolB, hedgeSpread, coverSpread):

self.q = q

self.initAccount = initAccount

self.status = 0

self.symbolA = symbolA

self.symbolB = symbolB

self.e = e

self.isBusy = False

self.hedgeSpread = hedgeSpread

self.coverSpread = coverSpread

self.opAmount = OpAmount

def poll(self):

if (self.isBusy or not exchange.IO("status")) or not ext.IsTrading(self.symbolA):

Sleep(1000)

return

insDetailA = exchange.SetContractType(self.symbolA)

if not insDetailA:

return

tickerA = exchange.GetTicker()

if not tickerA:

return

insDetailB = exchange.SetContractType(self.symbolB)

if not insDetailB:

return

tickerB = exchange.GetTicker()

if not tickerB:

return

LogStatus(_D(), "A卖B买", _N(tickerA["Buy"] - tickerB["Sell"]), "A买B卖", _N(tickerA["Sell"] - tickerB["Buy"]))

action = 0

if self.status == 0:

if (tickerA["Buy"] - tickerB["Sell"]) > self.hedgeSpread:

Log("开仓 A卖B买", tickerA["Buy"], tickerB["Sell"], "#FF0000")

action = 1

elif (tickerB["Buy"] - tickerA["Sell"]) > self.hedgeSpread:

Log("开仓 B卖A买", tickerB["Buy"], tickerA["Sell"], "#FF0000")

action = 2

elif self.status == 1 and (tickerA["Sell"] - tickerB["Buy"]) <= self.coverSpread:

Log("平仓 A买B卖", tickerA["Sell"], tickerB["Buy"], "#FF0000")

action = 2

elif self.status == 2 and (tickerB["Sell"] - tickerA["Buy"]) <= self.coverSpread:

Log("平仓 B买A卖", tickerB["Sell"] - tickerA["Buy"], "#FF0000")

action = 1

if action == 0:

return

self.isBusy = True

tasks = []

if action == 1:

tasks.append([self.symbolA, "sell" if self.status == 0 else "closebuy"])

tasks.append([self.symbolB, "buy" if self.status == 0 else "closesell"])

elif action == 2:

tasks.append([self.symbolA, "buy" if self.status == 0 else "closesell"])

tasks.append([self.symbolB, "sell" if self.status == 0 else "closebuy"])

def callBack(task, ret):

def callBack(task, ret):

self.isBusy = False

if task["action"] == "sell":

self.status = 2

elif task["action"] == "buy":

self.status = 1

else:

self.status = 0

account = _C(exchange.GetAccount)

LogProfit(account["Balance"] - self.initAccount["Balance"], account)

self.q.pushTask(self.e, tasks[1][0], tasks[1][1], self.opAmount, callBack)

self.q.pushTask(self.e, tasks[0][0], tasks[0][1], self.opAmount, callBack)

def main():

SetErrorFilter("ready|login|timeout")

Log("正在与交易服务器连接...")

while not exchange.IO("status"):

Sleep(1000)

Log("与交易服务器连接成功")

initAccount = _C(exchange.GetAccount)

Log(initAccount)

n = 0

def callBack(task, ret):

Log(task["desc"], "成功" if ret else "失败")

q = ext.NewTaskQueue(callBack)

if CoverAll:

Log("开始平掉所有残余仓位...")

ext.NewPositionManager().CoverAll()

Log("操作完成")

t = Hedge(q, exchange, initAccount, SA, SB, HedgeSpread, CoverSpread)

while True:

q.poll()

t.poll()

只是移植一下代码,感觉有点太简单了,我们继续来做一些改造,给策略加上图表。

在LogStatus函数调用的位置之前加上以下代码,把实时的价格差做成K线统计出来,self.preBarTime是Hedge类增加的一个成员,用来记录最新BAR的时间戳,画图我们使用「画线类库」,直接调用画图接口,很简单就可以画出图表。

# 计算差价K线

r = exchange.GetRecords()

if not r:

return

diff = tickerB["Last"] - tickerA["Last"]

if r[-1]["Time"] != self.preBarTime:

# 更新

self.records.append({"Time": r[-1]["Time"], "High": diff, "Low": diff, "Open": diff, "Close": diff, "Volume": 0})

self.preBarTime = r[-1]["Time"]

if diff > self.records[-1]["High"]:

self.records[-1]["High"] = diff

if diff < self.records[-1]["Low"]:

self.records[-1]["Low"] = diff

self.records[-1]["Close"] = diff

ext.PlotRecords(self.records, "diff:B-A")

ext.PlotHLine(self.hedgeSpread if diff > 0 else -self.hedgeSpread, "hedgeSpread")

ext.PlotHLine(self.coverSpread if diff > 0 else -self.coverSpread, "coverSpread")

回测时的效果:

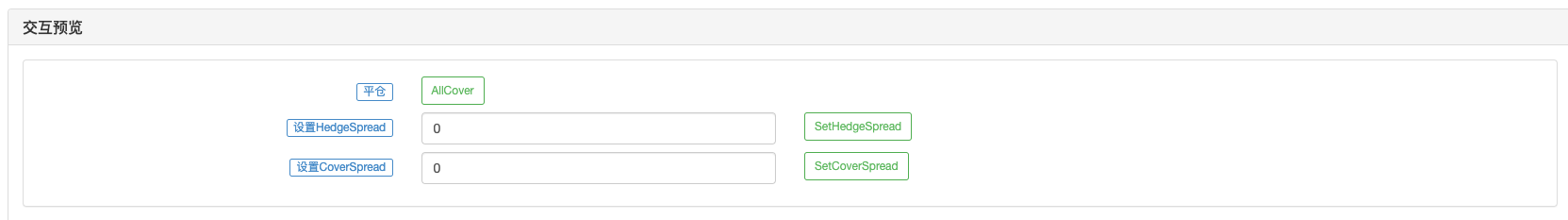

接下来,我们再加入交互功能,让策略在运行时可以修改HedgeSpread和CoverSpread参数,控制对冲开仓差价、平仓差价。还需要一个一键平仓的按钮。我们在策略编辑页面增加这几个控件。

然后在策略的主循环中,q.poll(),t.poll()调用之后,加上交互控制代码。

while True:

q.poll()

t.poll()

# 以下交互控制代码

cmd = GetCommand()

if cmd:

arr = cmd.split(":")

if arr[0] == "AllCover":

p.CoverAll()

elif arr[0] == "SetHedgeSpread":

t.SetHedgeSpread(float(arr[1]))

elif arr[0] == "SetCoverSpread":

t.SetCoverSpread(float(arr[1]))

策略用于教学,实盘根据自身需求优化调整。 如有问题,欢迎留言。

相关推荐

- 港股美股量化交易指南(一)

- 给商品期货策略加上一个闹钟--策略中的定时设计

- 机器人微信消息推送实现方案

- 图解正反马丁格尔策略

- 商品期货移仓类库

- 筑底形态ZDZB策略

- 乖离率BIAS策略

- 简易波动EMV策略

- Python版商品期货跨期布林对冲策略 (教学)

- 基于优宽量化基本面数据的商品期现套利图表

- Python版商品期货多品种均线策略

- 升级商品期货多品种海龟交易策略以及回测说明

- 鳄鱼线交易系统Python版

- 基于新型相对强弱指数在日内策略中的使用

- 基于Alpha101语法开发的增强分析工具

- 商品期货R-Breaker策略

- 商品期货多品种均线策略

- 商品期货量能足迹图footprint chart分析与实现

- JavaScript策略设计时数值计算精度问题解决方案

- 利用pyfolio工具评价回测资金曲线