股票多品种平衡策略设计教学

创建于: 2022-03-07 13:50:52,

更新于:

2024-11-26 20:40:58

0

0

727

727

股票多品种平衡策略设计教学

鉴于股票策略在youquant.com上相对较少,喜欢研究股票程序化、量化交易的同学们借鉴、参考的内容不多。为了更加方便程序化、量化交易入门的同学学习、研究。本篇我们一起来实现一个简单的股票多品种策略设计。OK!撸起袖子加油~宽客们。

策略思路

策略思路很简单,借鉴于youquant.com站的一个策略。同类型的策略在不可描述的区块市场上也有所作为。

策略逻辑简单说就是: 以账户初期资产为基数,根据策略参数设置一个百分比,计算出每只股票的持有价值。设置的股票池参数中每只股票按持有价值持仓。当价格上涨,使持仓的价值超过既定的持仓价值时,卖出一部分股票平衡到最初的持仓价值。当价格下跌,使持仓的价值低于既定的持仓价值时,买入一部分股票平衡到最初的持仓价值。

策略是不是非常简单。

实现策略

参数设计:

策略代码:

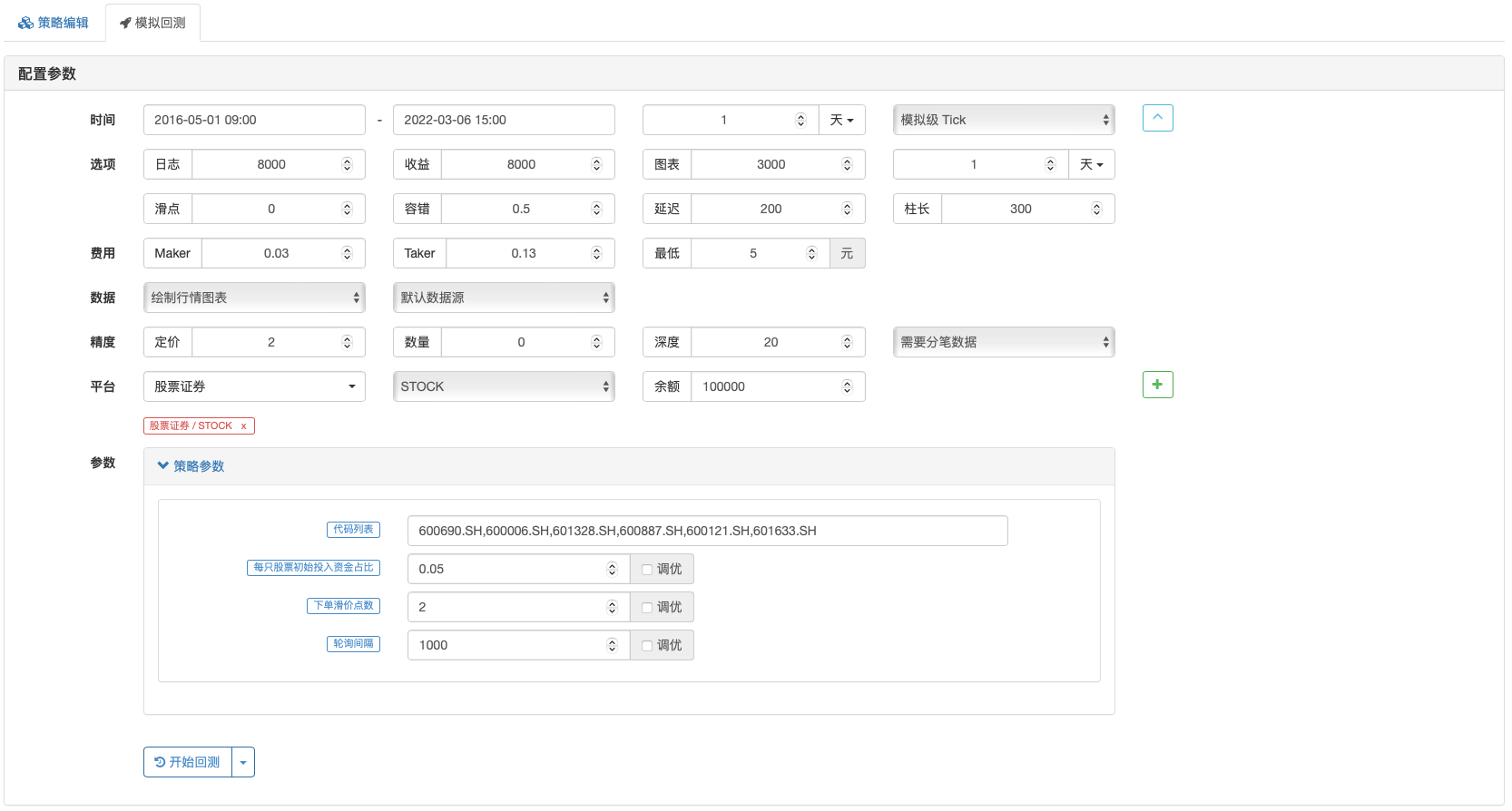

/*backtest

start: 2016-05-01 09:00:00

end: 2022-03-06 15:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_XTP","currency":"STOCK","balance":100000,"minFee":0}]

args: [["contractTypes","600519.SH,600690.SH,600006.SH,601328.SH,600887.SH,600121.SH,601633.SH"]]

*/

// 全局变量

var StatusMsg = ""

function newDate() {

var timezone = 8 //目标时区时间,东八区

var offset_GMT = new Date().getTimezoneOffset() // 本地时间和格林威治的时间差,单位为分钟

var nowDate = new Date().getTime() // 本地时间距 1970 年 1 月 1 日午夜(GMT 时间)之间的毫秒数

var targetDate = new Date(nowDate + offset_GMT * 60 * 1000 + timezone * 60 * 60 * 1000)

return targetDate

}

function GetPosition(e, contractTypeName) {

var allAmount = 0

var allProfit = 0

var allFrozen = 0

var posMargin = 0

var price = 0

var direction = null

positions = _C(e.GetPosition)

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType != contractTypeName) {

continue

}

if (positions[i].Type == PD_LONG) {

posMargin = positions[i].MarginLevel

allAmount += positions[i].Amount

allProfit += positions[i].Profit

allFrozen += positions[i].FrozenAmount

price = positions[i].Price

direction = positions[i].Type

}

}

if (allAmount === 0) {

return null

}

return {

MarginLevel: posMargin,

FrozenAmount: allFrozen,

Price: price,

Amount: allAmount,

Profit: allProfit,

Type: direction,

ContractType: contractTypeName,

CanCoverAmount: allAmount - allFrozen

}

}

function Buy(e, contractType, opAmount, insDetail) {

var initPosition = GetPosition(e, contractType)

var isFirst = true

var initAmount = initPosition ? initPosition.Amount : 0

var positionNow = initPosition

if(opAmount % insDetail.LotSize != 0) {

throw "每手数量不匹配"

}

while (true) {

var needOpen = opAmount

if (isFirst) {

isFirst = false

} else {

Sleep(Interval*20)

positionNow = GetPosition(e, contractType)

if (positionNow) {

needOpen = opAmount - (positionNow.Amount - initAmount)

}

Log("positionNow:", positionNow, "needOpen:", needOpen)// 测试

}

if (needOpen < insDetail.LotSize || needOpen % insDetail.LotSize != 0) {

break

}

var depth = _C(e.GetDepth)

// 需要检测是否涨跌停

var amount = needOpen

e.SetDirection("buy")

var orderId = e.Buy(depth.Asks[0].Price + (insDetail.PriceSpread * SlideTick), amount, contractType, 'Ask', depth.Asks[0])

// CancelPendingOrders

while (true) {

Sleep(Interval*20)

var orders = _C(e.GetOrders)

if (orders.length === 0) {

break

}

for (var j = 0; j < orders.length; j++) {

e.CancelOrder(orders[j].Id)

if (j < (orders.length - 1)) {

Sleep(Interval*20)

}

}

}

}

var ret = null

if (!positionNow) {

return ret

}

ret = positionNow

return ret

}

function Sell(e, contractType, lots, insDetail) {

var initAmount = 0

var firstLoop = true

if(lots % insDetail.LotSize != 0) {

throw "每手数量不匹配"

}

while (true) {

var n = 0

var total = 0

var positions = _C(e.GetPosition)

var nowAmount = 0

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType != contractType) {

continue

}

nowAmount += positions[i].Amount

}

if (firstLoop) {

initAmount = nowAmount

firstLoop = false

}

var amountChange = initAmount - nowAmount

if (typeof(lots) == 'number' && amountChange >= lots) {

break

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType != contractType) {

continue

}

var amount = positions[i].Amount

var depth

var opAmount = 0

var opPrice = 0

if (positions[i].Type == PD_LONG) {

depth = _C(e.GetDepth)

// 需要检测是否涨跌停

opAmount = amount

opPrice = depth.Bids[0].Price - (insDetail.PriceSpread * SlideTick)

}

if (typeof(lots) === 'number') {

opAmount = Math.min(opAmount, lots - (initAmount - nowAmount))

}

if (opAmount > 0) {

if (positions[i].Type == PD_LONG) {

e.SetDirection("closebuy")

e.Sell(opPrice, opAmount, contractType, "平仓", 'Bid', depth.Bids[0])

}

n++

}

// break to check always

if (typeof(lots) === 'number') {

break

}

}

if (n === 0) {

break

}

while (true) {

Sleep(Interval*20)

var orders = _C(e.GetOrders)

if (orders.length === 0) {

break

}

for (var j = 0; j < orders.length; j++) {

e.CancelOrder(orders[j].Id)

if (j < (orders.length - 1)) {

Sleep(Interval*20)

}

}

}

}

}

/*

1、9:15-9:25为开盘集合竞价;

2、9:30-11:30,13:00-14:57为连续竞价阶段;

3、14:57-15:00为收盘集合竞价。

*/

function IsTrading() {

var now = newDate() // 使用 newDate() 代替 new Date() 因为服务器时区问题

var day = now.getDay()

var hour = now.getHours()

var minute = now.getMinutes()

StatusMsg = "非交易时段"

if (day === 0 || day === 6) {

return false

}

if((hour == 9 && minute >= 30) || (hour == 11 && minute < 30) || (hour > 9 && hour < 11)) {

// 9:30-11:30

StatusMsg = "交易时段"

return true

} else if (hour >= 13 && hour < 15) {

// 13:00-15:00

StatusMsg = "交易时段"

return true

}

return false

}

function main(){

var cts = contractTypes.split(",")

var acc = _C(exchange.GetAccount)

var value = _N(acc.Balance * ratio, 0)

while (true) {

var rowsData = []

_.each(cts, function(ct) {

if (!IsTrading()) {

return

}

var info = exchange.SetContractType(ct)

if (!info) {

return

}

var ticker = exchange.GetTicker()

if (!ticker) {

return

}

if (IsVirtual()) {

ticker.Info = {}

ticker.Info.LotSize = info.VolumeMultiple

ticker.Info.PriceSpread = 0.01

}

var pos = GetPosition(exchange, ct)

if (!pos) {

// 没有持仓,按照价值建仓

var amount = parseInt(value / ticker.Last / info.VolumeMultiple)

if (amount < 1) {

return

}

amount = amount * info.VolumeMultiple

Buy(exchange, ct, amount, ticker.Info)

} else {

// 计算价值偏离,平衡仓位

var nowValue = ticker.Last * pos.Amount

var diffValue = nowValue - value

if (diffValue > 0) {

// 持有价值增加超过阈值

var amount = parseInt(diffValue / ticker.Last / info.VolumeMultiple)

if (amount >= 1) {

// 平衡

amount = amount * info.VolumeMultiple

Sell(exchange, ct, amount, ticker.Info)

var newPos = GetPosition(exchange, ct)

Log("当前持仓价值:", pos.Amount + " * " + ticker.Last + " = " + nowValue, ",初期价值:", value, ",本次平衡价值:", amount * ticker.Last, ",平衡后的持仓价值:", newPos.Amount * ticker.Last)

}

} else if (diffValue < 0) {

// 持有价值减少超过阈值

var amount = parseInt(-diffValue / ticker.Last / info.VolumeMultiple)

if (amount >= 1) {

// 平衡

amount = amount * info.VolumeMultiple

Buy(exchange, ct, amount, ticker.Info)

var newPos = GetPosition(exchange, ct)

Log("当前持仓价值:", pos.Amount + " * " + ticker.Last + " = " + nowValue, ",初期价值:", value, ",本次平衡价值:", amount * ticker.Last, ",平衡后的持仓价值:", newPos.Amount * ticker.Last)

}

}

}

rowsData.push([info.InstrumentID, info.InstrumentName, info.VolumeMultiple, ticker.Last, pos ? pos.Price : "--", pos ? pos.Amount : "--", value, pos ? ticker.Last * pos.Amount : "--"])

})

var tbl = {

"type" : "table",

"title" : "行情、持仓数据",

"cols" : ["股票代码", "名称", "一手乘数", "当前价格", "持仓价格", "持仓数量", "初期价值", "当前价值"],

"rows" : rowsData

}

LogStatus("日期时间:", _D(), ", 状态信息:", StatusMsg, "\n`" + JSON.stringify(tbl) + "`")

Sleep(1000)

}

}

策略主要逻辑就在于对于持仓价值的计算。计算偏移出的价值是否足够至少一手的交易量。

if (!pos) {

// 没有持仓,按照价值建仓

var amount = parseInt(value / ticker.Last / info.VolumeMultiple)

if (amount < 1) {

return

}

amount = amount * info.VolumeMultiple

Buy(exchange, ct, amount, ticker.Info)

} else {

// 计算价值偏离,平衡仓位

var nowValue = ticker.Last * pos.Amount

var diffValue = nowValue - value

if (diffValue > 0) {

// 持有价值增加超过阈值

var amount = parseInt(diffValue / ticker.Last / info.VolumeMultiple)

if (amount >= 1) {

// 平衡

amount = amount * info.VolumeMultiple

Sell(exchange, ct, amount, ticker.Info)

var newPos = GetPosition(exchange, ct)

Log("当前持仓价值:", pos.Amount + " * " + ticker.Last + " = " + nowValue, ",初期价值:", value, ",本次平衡价值:", amount * ticker.Last, ",平衡后的持仓价值:", newPos.Amount * ticker.Last)

}

} else if (diffValue < 0) {

// 持有价值减少超过阈值

var amount = parseInt(-diffValue / ticker.Last / info.VolumeMultiple)

if (amount >= 1) {

// 平衡

amount = amount * info.VolumeMultiple

Buy(exchange, ct, amount, ticker.Info)

var newPos = GetPosition(exchange, ct)

Log("当前持仓价值:", pos.Amount + " * " + ticker.Last + " = " + nowValue, ",初期价值:", value, ",本次平衡价值:", amount * ticker.Last, ",平衡后的持仓价值:", newPos.Amount * ticker.Last)

}

}

}

策略回测

平衡策略用于操作多只股票组成的股票池,可以分散投资。回测中每只股票投入资金只有5000元,并且根据价格变动不断调整持仓。由于策略开始需要持有底仓,等于开始做多。所以最好还是选择一些潜力较好的股票。

策略地址:https://www.youquant.com/strategy/349108

当然,策略回测仅供于参考。策略设计仅仅为了学习、研究,实盘还需进一步的优化、升级。

对于0基础的小伙伴来说以上的策略代码可能有些难懂。所以,对于不会编程、交易的小伙伴们推荐一本非常实用的书籍,无缝贴合http://youquant.com量化交易平台的量化交易实战,会非常方便入门量化交易领域。

相关推荐

- 期货市场血亏3300元,怒花半小时写出21行年化100%的玻璃期货策略

- 商品期货量化交易必学的知识--基于tick数据推算逐笔交易历史

- 当优宽遇到ChatGPT,记一次使用AI来辅助学习量化交易的尝试

- 商品期货跨品种套利模型

- 教你使用python实现一个止盈止损类库

- 交易中跟踪止盈止损的设计

- 简单的贝叶斯定理理解与商品期货应用实践讨论

- 设计伪高频策略以及使用实盘级别回测来研究伪高频策略

- 满墙的显示器太浪费!80行代码的实盘帮你搞定

- 什么是美股盘前盘后交易?带您了解如何获取盘前盘后价格数据

- 股票多品种海龟交易策略设计范例

- 优宽上使用富途证券SDK选股范例与讲解

- 在优宽获取股票市场股票代码集合的实践

- 商品期货资金管理策略(教学)

- 优宽上玩转麦语言你所需要知道的事情--麦语言交易类库参数篇

- 优宽上玩转麦语言你所需要知道的事情--界面图表篇

- 商品期货等差网格策略

- 一个品种多个策略要跑怎么办——python多进程数据分发解决方案分享

- My语言策略实时推送仓位变化到手机App与微信

- 港股多品种对冲策略(2)