你好,交易员们,

该指标与我之前的指标“CCI MTF Ob+Os”使用相同的概念。

这是一个简单的“相对强弱指数”(RSI)指标,具有多时间段(MTF)超买和超卖水平。

它可以在多达5个时间段内检测超买和超卖水平,这有助于交易员更容易地发现潜在的反转点。

可以选择1-5个时间段来检测超买和超卖。

湖绿色背景是“超卖”,寻找“多头”。 橙色背景为“超买”,寻找“空头”。

玩得开心:)

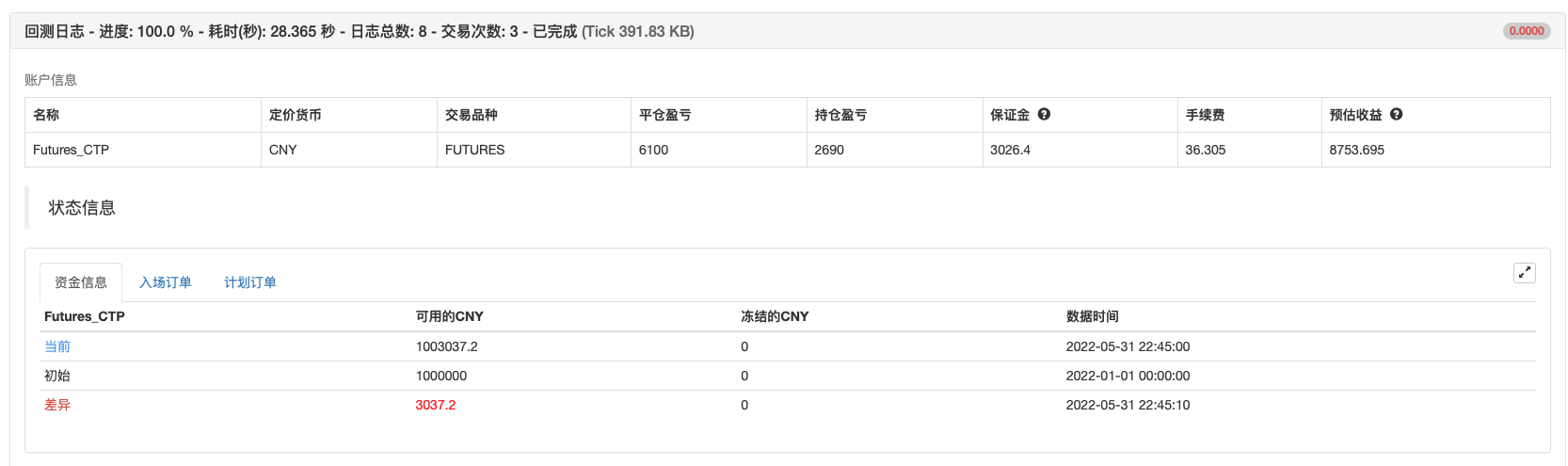

策略回测

策略源码

/*backtest

start: 2022-01-01 00:00:00

end: 2022-06-01 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["v_input_int_1",9],["v_input_int_2",70],["v_input_int_3",30],["ContractType","hc2210",360008]]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © thakon33

// __ __ __ ____ ____

// / /_/ / ___ _/ /_____ ___ |_ /|_ /

// / __/ _ \/ _ `/ '_/ _ \/ _ \_/_ <_/_ <

// \__/_//_/\_,_/_/\_\\___/_//_/____/____/

//@version=5

indicator("RSI MTF Ob+Os")

//------------------------------------------------------------------------------

// Input

var g_rsi = "[ RSI SETTING ]"

rsiSrc = input (title="数据源", defval=close, group=g_rsi)

rsiLength = input.int(title="周期", defval=14, minval=1, group=g_rsi)

rsiOverbought = input.int(title="超买", defval=60, minval=50, maxval=99, step=1, group=g_rsi)

rsiOversold = input.int(title="超卖", defval=40, minval=1, maxval=50, step=1, group=g_rsi)

var g_tf = "[ SELECT TIMEFRAME ]"

rsiTf1 = input.timeframe(title="时间框架 1", defval="15", group=g_tf, inline="tf1")

rsiTf2 = input.timeframe(title="时间框架 2", defval="30", group=g_tf, inline="tf2")

rsiTf3 = input.timeframe(title="时间框架 3", defval="60", group=g_tf, inline="tf3")

rsiTf4 = input.timeframe(title="时间框架 4", defval="120", group=g_tf, inline="tf4")

rsiTf5 = input.timeframe(title="时间框架 5", defval="240", group=g_tf, inline="tf5")

rsiTf1_E = input.bool(title="是否使用 时间框架1", defval=true, group=g_tf, inline="tf1")

rsiTf2_E = input.bool(title="是否使用 时间框架2", defval=true, group=g_tf, inline="tf2")

rsiTf3_E = input.bool(title="是否使用 时间框架3", defval=true, group=g_tf, inline="tf3")

rsiTf4_E = input.bool(title="是否使用 时间框架4", defval=true, group=g_tf, inline="tf4")

rsiTf5_E = input.bool(title="是否使用 时间框架5", defval=true, group=g_tf, inline="tf5")

//------------------------------------------------------------------------------

// Calculate RSI

Fsec(Sym, Tf, Exp) =>

request.security(Sym, Tf, Exp[barstate.isrealtime ? 1 : 0], barmerge.gaps_off, barmerge.lookahead_off) [barstate.isrealtime ? 0 : 1]

rsi1 = Fsec(syminfo.tickerid, rsiTf1, ta.rsi(rsiSrc, rsiLength))

rsi2 = Fsec(syminfo.tickerid, rsiTf2, ta.rsi(rsiSrc, rsiLength))

rsi3 = Fsec(syminfo.tickerid, rsiTf3, ta.rsi(rsiSrc, rsiLength))

rsi4 = Fsec(syminfo.tickerid, rsiTf4, ta.rsi(rsiSrc, rsiLength))

rsi5 = Fsec(syminfo.tickerid, rsiTf5, ta.rsi(rsiSrc, rsiLength))

//------------------------------------------------------------------------------

// RSI Overbought and Oversold detect

rsi1_Ob = not rsiTf1_E or rsi1 >= rsiOverbought

rsi2_Ob = not rsiTf2_E or rsi2 >= rsiOverbought

rsi3_Ob = not rsiTf3_E or rsi3 >= rsiOverbought

rsi4_Ob = not rsiTf4_E or rsi4 >= rsiOverbought

rsi5_Ob = not rsiTf5_E or rsi5 >= rsiOverbought

rsi1_Os = not rsiTf1_E or rsi1 <= rsiOversold

rsi2_Os = not rsiTf2_E or rsi2 <= rsiOversold

rsi3_Os = not rsiTf3_E or rsi3 <= rsiOversold

rsi4_Os = not rsiTf4_E or rsi4 <= rsiOversold

rsi5_Os = not rsiTf5_E or rsi5 <= rsiOversold

rsiOb = rsi1_Ob and rsi2_Ob and rsi3_Ob and rsi4_Ob and rsi5_Ob

rsiOs = rsi1_Os and rsi2_Os and rsi3_Os and rsi4_Os and rsi5_Os

//------------------------------------------------------------------------------

// Drawing on chart

plot (rsiTf1_E ? rsi1 : na, title="TF 1", color=color.rgb(255, 205, 22, 20), linewidth=1)

plot (rsiTf2_E ? rsi2 : na, title="TF 2", color=color.rgb(255, 22, 239, 20), linewidth=1)

plot (rsiTf3_E ? rsi3 : na, title="TF 3", color=color.rgb(38, 22, 255, 0), linewidth=1)

plot (rsiTf4_E ? rsi4 : na, title="TF 4", color=color.rgb(123, 253, 22, 20), linewidth=1)

plot (rsiTf5_E ? rsi5 : na, title="TF 5", color=color.rgb(0, 255, 255, 50), linewidth=1)

strategy.entry("BUY", strategy.long, when=rsiOb)

strategy.entry("SELL", strategy.short, when=rsiOs)

//==============================================================================

//==============================================================================

相关推荐