此脚本是@borserman的HMA指标脚本的修改版本。 EHMA的所有功劳都归他所有:)

除了EHMA之外,该脚本还可以在EHMA周围的范围内工作(可以修改),以抵抗虚假信号。很多时候,一个K线BAR的收盘价会低于移动平均线,而下一个K线BAR的收盘价又会反转,这会吞噬你的利润。尤其是在较短的时间段上,但在波动较大的较长时间段上,这可能会使策略不具吸引力。

在EHMA附近的范围内,只有当一根K线BAR越过上限时,该策略才会进入多头/空头位置。反之亦然,只有当一根K线BAR穿过较低范围时,它才会进入短/出口长位置。这避免了在EHMA范围内波动的酒吧头寸&只有在市场对其方向有信心的情况下才进入头寸。尽管如此,伪造仍然是可能的,但频率要低得多。与常规EHMA策略相比,该策略进行了回溯测试(并对各种设置进行了实验),该版本似乎更加稳健和有利可图!

免责声明 请记住,过去的表现可能并不代表未来的结果。 由于各种因素,包括不断变化的市场条件,该策略的表现可能不再像历史回溯测试那样好。 这篇文章和脚本没有提供任何财务建议。

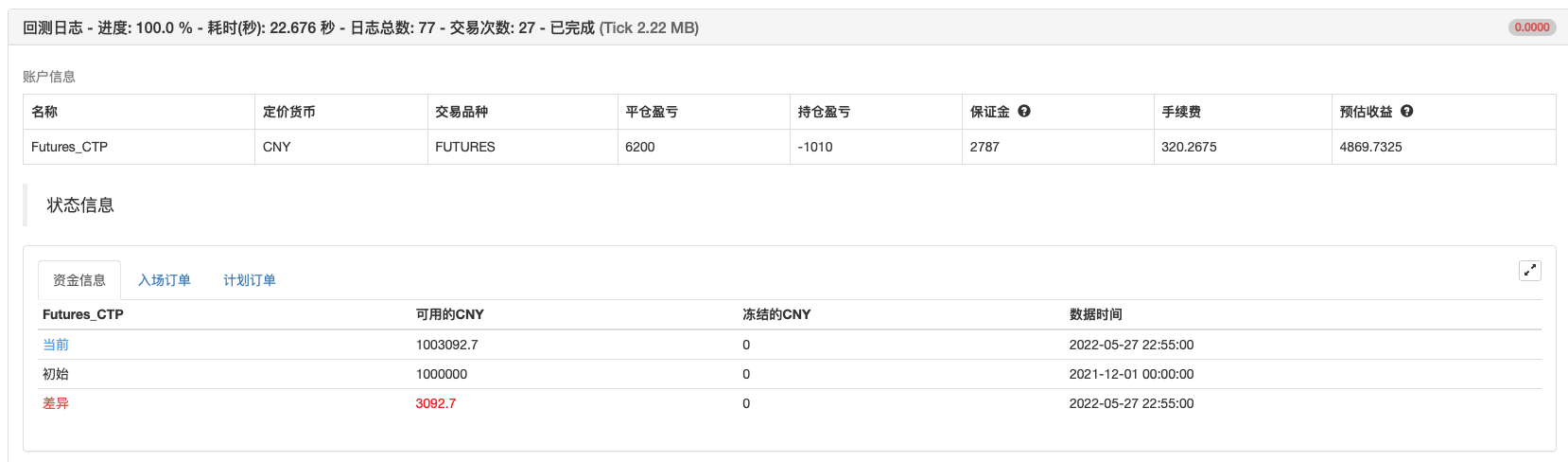

回测测试

策略源码

/*backtest

start: 2021-12-01 00:00:00

end: 2022-05-30 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["ContractType","hc2210",360008]]

*/

// Credit is due where credit is due:

// Hull Moving Average: developed by Alan Hull

// EHMA: coded by Twitter @borserman

// I've built on their work in an attempt to create a strategy more robust to fake moves

// @0xLetoII

//@version=4

//strategy(

// title="EHMA Range Strategy",

// process_orders_on_close=true,

// explicit_plot_zorder=true,

// overlay=true,

// initial_capital=1500,

// default_qty_type=strategy.percent_of_equity,

// commission_type=strategy.commission.percent,

// commission_value=0.085,

// default_qty_value=100

// )

// Position Type

pos_type = input(defval = "Both", title="持仓设置", options=["Both", "Long", "Short"])

// Inputs

Period = input(defval=300, title="周期")

RangeWidth = input(defval=0.02, step=0.01, title="范围宽度")

sqrtPeriod = sqrt(Period)

// Function for the Borserman EMA

borserman_ema(x, y) =>

alpha = 2 / (y + 1)

sum = 0.0

sum := alpha * x + (1 - alpha) * nz(sum[1])

// Calculate the Exponential Hull Moving Average

EHMA = borserman_ema(2 * borserman_ema(close, Period / 2) - borserman_ema(close, Period), sqrtPeriod)

// Create upper & lower bounds around the EHMA for broader entries & exits

upper = EHMA + (EHMA * RangeWidth)

lower = EHMA - (EHMA * RangeWidth)

// Plots

EHMAcolor = (close > EHMA ? color.green : color.red)

plot(EHMA, color=EHMAcolor, linewidth=2)

plot(lower, color=color.orange, linewidth=2)

plot(upper, color=color.blue, linewidth=2)

// Strategy

long = close > upper

exit_long = close < lower

short = close < lower

exit_short = close > upper

// Calculate start/end date and time condition

//startDate = input(timestamp("2017-01-01T00:00:00"))

//finishDate = input(timestamp("2029-01-01T00:00:00"))

time_cond = true

// Entries & Exits

if pos_type == "Both"

strategy.entry("Long", strategy.long, comment="Long", when=long and time_cond)

strategy.close("Long", comment="Exit Long", when=exit_long and time_cond)

strategy.entry("Short", strategy.short, comment="Short", when=short and time_cond)

strategy.close("Short", comment="Exit Short", when=exit_short and time_cond)

if pos_type == "Long"

strategy.entry("Long", strategy.long, comment="Long", when=long and time_cond)

strategy.close("Long", comment="Exit Long", when=exit_long and time_cond)

if pos_type == "Short"

strategy.entry("Short", strategy.short, comment="Short", when=short and time_cond)

strategy.close("Short", comment="Exit Short", when=exit_short and time_cond)

相关推荐