回测测试

策略源码

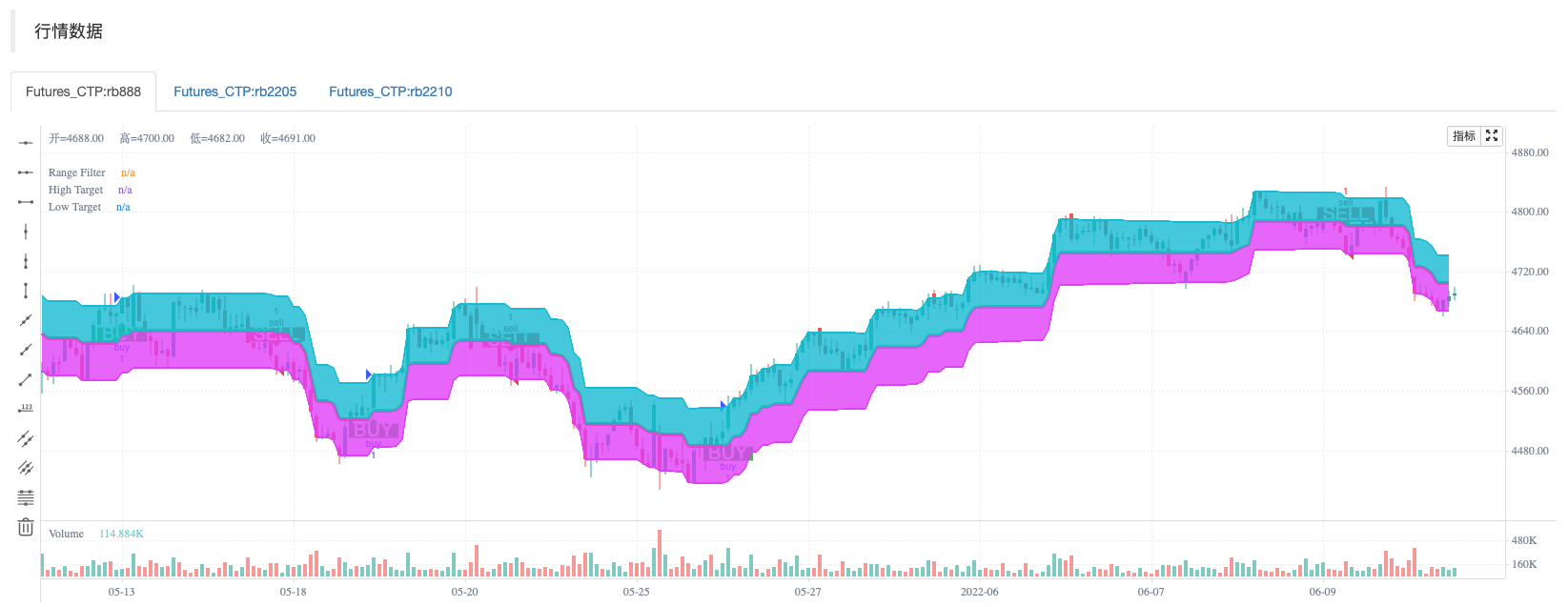

/*backtest

start: 2022-01-01 09:00:00

end: 2022-06-13 15:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["ContractType","rb888",360008]]

*/

//@version=3

strategy(title="Range Filter Buy and Sell 5min [Strategy]", overlay=true)

sources = input(defval=close, title="数据源")

isHA = input(false, "使用 HA", bool)

src = isHA ? security(heikenashi(tickerid), period, sources) : sources

// Sampling Period

// Settings for 5min chart, BTCUSDC. For Other coin, change the paremeters

per = input(defval=50, minval=1, title="采样周期")

// Range Multiplier

mult = input(defval=3.0, minval=0.1, title="范围乘数")

// Smooth Average Range

smoothrng(x, t, m)=>

wper = (t*2) - 1

avrng = ema(abs(x - x[1]), t)

smoothrng = ema(avrng, wper)*m

smoothrng

smrng = smoothrng(src, per, mult)

// Range Filter

rngfilt(x, r)=>

rngfilt = x

rngfilt := x > nz(rngfilt[1]) ? ((x - r) < nz(rngfilt[1]) ? nz(rngfilt[1]) : (x - r)) : ((x + r) > nz(rngfilt[1]) ? nz(rngfilt[1]) : (x + r))

rngfilt

filt = rngfilt(src, smrng)

// Filter Direction

upward = 0.0

upward := filt > filt[1] ? nz(upward[1]) + 1 : filt < filt[1] ? 0 : nz(upward[1])

downward = 0.0

downward := filt < filt[1] ? nz(downward[1]) + 1 : filt > filt[1] ? 0 : nz(downward[1])

// Target Bands

hband = filt + smrng

lband = filt - smrng

// Colors

filtcolor = upward > 0 ? lime : downward > 0 ? red : orange

barcolor = (src > filt) and (src > src[1]) and (upward > 0) ? lime : (src > filt) and (src < src[1]) and (upward > 0) ? green :

(src < filt) and (src < src[1]) and (downward > 0) ? red : (src < filt) and (src > src[1]) and (downward > 0) ? maroon : orange

filtplot = plot(filt, color=filtcolor, linewidth=3, title="Range Filter")

// Target

hbandplot = plot(hband, color=aqua, transp=100, title="High Target")

lbandplot = plot(lband, color=fuchsia, transp=100, title="Low Target")

// Fills

fill(hbandplot, filtplot, color=aqua, title="High Target Range")

fill(lbandplot, filtplot, color=fuchsia, title="Low Target Range")

// Bar Color

//barcolor(barcolor)

// Break Outs

longCond = na

shortCond = na

longCond := ((src > filt) and (src > src[1]) and (upward > 0)) or ((src > filt) and (src < src[1]) and (upward > 0))

shortCond := ((src < filt) and (src < src[1]) and (downward > 0)) or ((src < filt) and (src > src[1]) and (downward > 0))

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

longCondition = longCond and CondIni[1] == -1

shortCondition = shortCond and CondIni[1] == 1

plotshape(longCondition, title = "Buy Signal", text ="BUY", textcolor = white, style=shape.labelup, size = size.normal, location=location.belowbar, color = green, transp = 0)

plotshape(shortCondition, title = "Sell Signal", text ="SELL", textcolor = white, style=shape.labeldown, size = size.normal, location=location.abovebar, color = red, transp = 0)

// === Stop LOSS ===

useStopLoss = input(false, title='----- 使用 止损 / 止盈 -----', type=bool)

sl_inp = input(100, title='止损 %', type=float, step=0.25)/100

tp_inp = input(1.5, title='止盈 %', type=float, step=0.25)/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

stop_level_short = strategy.position_avg_price * (1 + sl_inp)

take_level_short = strategy.position_avg_price * (1 - tp_inp)

// === Stop LOSS ===

if useStopLoss

strategy.exit("Stop Loss/Profit Long","Long", stop=stop_level, limit=take_level)

strategy.exit("Stop Loss/Profit Short","Short", stop=stop_level_short, limit=take_level_short)

if longCondition

strategy.entry("buy", strategy.long)

else if shortCondition

strategy.entry("sell", strategy.short)

相关推荐