0

关注

172

关注者

回测测试

策略源码

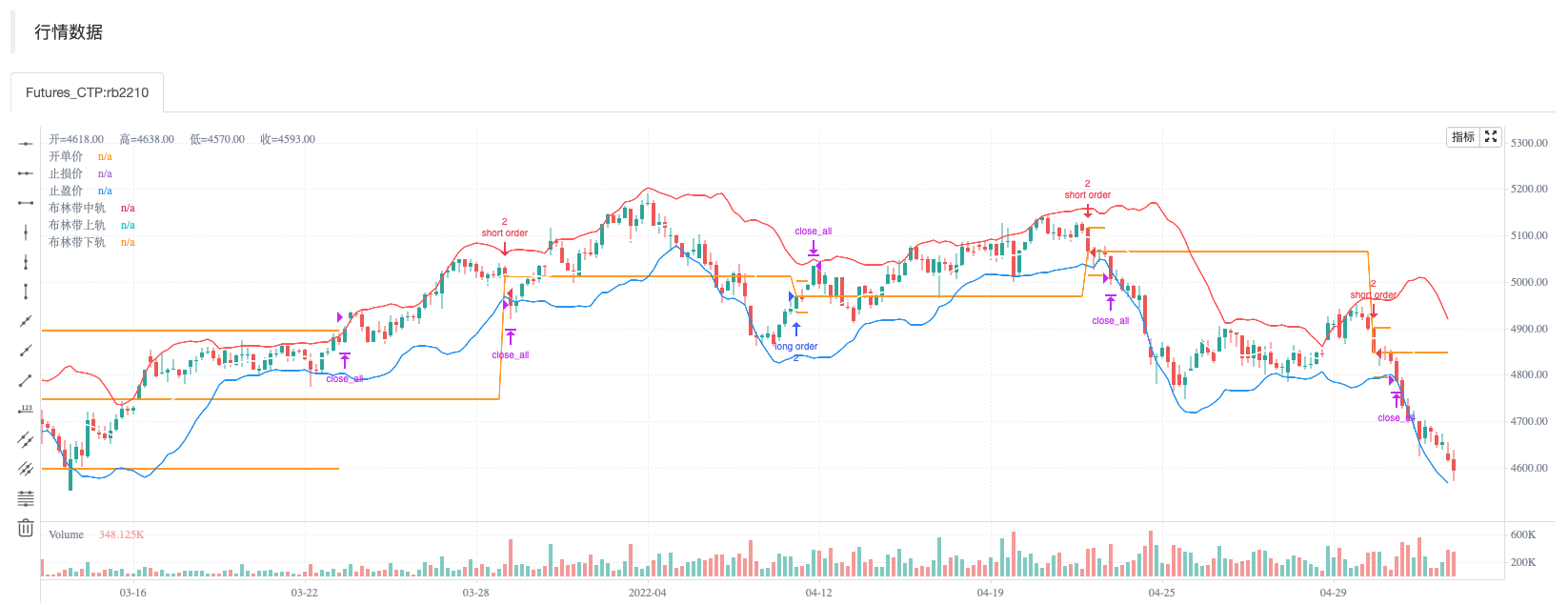

/*backtest

start: 2022-01-01 00:00:00

end: 2022-05-09 23:59:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["ContractType","rb2210",360008]]

*/

//@version=5

// # ========================================================================= #

// # | STRATEGY |

// # ========================================================================= #

strategy(title = "NMVOB-S", shorttitle = "NMVOB-S", overlay = true , calc_on_every_tick = false , initial_capital = 0)

// # ========================================================================= #

// # | 全局变量 START |

// # ========================================================================= #

var current_trend = int(na)

var open_order_type = int(na)

var stop_loss_price = float(na)

var stop_profit_price = float(na)

var sl = float(na)

var open_order_price = float(na)

var open_type_flag = int(na)

var stop_profit_flag = 0

var macd_signal_position = 0

var macd_signal_type = int(na)

var start_price = input.float(10000, "起始资金")

var volumeMultiple = input.int(10, "乘数")

var gg = input.int(10, "杠杆")

// # ========================================================================= #

// # | 全局变量 END |

// # ========================================================================= #

// # ========================================================================= #

// # | 自定义函数 START |

// # ========================================================================= #

stop_loss_pillars = input(defval = 0, title = "止损柱数量")

stop_profit_proportion = input.float(1,"止盈比例")

//计算止损价

calculate_stop_loss() =>

if current_trend == 1

stop_loss_price_buy = low

if stop_loss_pillars == 0

stop_loss_price_buy

else

for i = 1 to stop_loss_pillars

if low[i] < stop_loss_price_buy

stop_loss_price_buy := low[i]

else if low[i] > stop_loss_price_buy

stop_loss_price_buy

stop_loss_price_buy

else

stop_loss_price_sell = high

if stop_loss_pillars == 0

stop_loss_price_sell

else

for i = 1 to stop_loss_pillars

if high[i] < stop_loss_price_sell

stop_loss_price_sell

else if high[i] > stop_loss_price_sell

stop_loss_price_sell := high[i]

stop_loss_price_sell

//计算止盈

calculate_stop_profit(cur_stop_loss_price) =>

value = math.abs(close - cur_stop_loss_price) * stop_profit_proportion

if current_trend == 1

close + value

else

close - value

// # ========================================================================= #

// # | 自定义函数 END |

// # ========================================================================= #

// # ========================================================================= #

// # | Normalized MACD |

// # ========================================================================= #

sma = input(13,title='MACD Fast MA')

lma = input(21,title='MACD Slow MA')

tsp = input(9,title='MACD Trigger')

np = input(20,title='MACD Normalize')

type = input.int(1,minval=1,maxval=3,title="(MACD) 1=Ema, 2=Wma, 3=Sma")

sh = type == 1 ? ta.ema(close,sma)

: type == 2 ? ta.wma(close, sma)

: ta.sma(close, sma)

lon=type == 1 ? ta.ema(close,lma)

: type == 2 ? ta.wma(close, lma)

: ta.sma(close, lma)

ratio = math.min(sh,lon)/math.max(sh,lon)

Mac = if sh>lon

2 - ratio - 1

else

ratio - 1

//快线

MacNorm = ((Mac-ta.lowest(Mac, np)) /(ta.highest(Mac, np)-ta.lowest(Mac, np)+.000001)*2)- 1

MacNorm2 = if np < 2

Mac

else

MacNorm

//慢线

Trigger = ta.wma(MacNorm2, tsp)

if ta.crossover(source1 = MacNorm, source2 = Trigger)

macd_signal_position := 0

macd_signal_type := 1

else if ta.crossunder(source1 = MacNorm, source2 = Trigger)

macd_signal_position := 0

macd_signal_type := 0

else

macd_signal_position += 1

// # ========================================================================= #

// # | Normalized MACD |

// # ========================================================================= #

// # ========================================================================= #

// # | Volatility Oscillator START |

// # ========================================================================= #

length = input(30, title="VS 周期")

spike = close - open

vs_up_line = ta.stdev(spike,length)

vs_low_line = ta.stdev(spike,length) * -1

// # ========================================================================= #

// # | Volatility Oscillator END |

// # ========================================================================= #

// # ========================================================================= #

// # | Bollinger Bands |

// # ========================================================================= #

b_length = input.int(15, minval=1 , title="布林带周期")

src = input(close, title="Boollinger Bands Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ta.sma(src, b_length)

dev = mult * ta.stdev(src, b_length)

upper = basis + dev

lower = basis - dev

offset = 0

plot(basis, "布林带中轨", color=color.white, offset = offset)

plot(upper, "布林带上轨", color=color.red, offset = offset)

plot(lower, "布林带下轨", color=color.blue, offset = offset)

// # ========================================================================= #

// # | Bollinger Bands |

// # ========================================================================= #

if true

if strategy.opentrades == 0 and barstate.isnew

//macd涨跌条件

long_macd_conditions = macd_signal_type == 1 and macd_signal_position <= 10

short_macd_conditions = macd_signal_type == 0 and macd_signal_position <= 10

// Volatility Oscillator 涨跌条件

long_vs_conditions = ta.crossover(source1 = spike, source2 = vs_up_line)

short_vs_conditions = ta.crossunder(source1 = spike, source2 = vs_low_line)

//布林带涨跌条件

long_bollinger_conditions = low < basis and close > basis and high < upper

short_bollinger_conditions = high > basis and close < basis and low > lower

//开多单条件

open_long_order_conditions = long_macd_conditions and long_vs_conditions and long_bollinger_conditions

//开空单条件

open_short_order_conditions = short_macd_conditions and short_vs_conditions and short_bollinger_conditions

if open_long_order_conditions

current_trend := 1

stop_loss_price := calculate_stop_loss()

stop_profit_price := calculate_stop_profit(stop_loss_price)

open_order_type := 1

sl := math.floor((start_price * gg) / (close * volumeMultiple))

open_order_price := close

open_type_flag := 1

if sl > 0

strategy.order(id = "long order", direction = strategy.long , qty = sl, limit = close, stop = stop_loss_price, comment = "多单", when = open_long_order_conditions)

else if open_short_order_conditions

current_trend := 0

stop_loss_price := calculate_stop_loss()

stop_profit_price := calculate_stop_profit(stop_loss_price)

open_order_type := 0

sl := math.floor((start_price * gg) / (close * volumeMultiple))

open_order_price := close

open_type_flag := 0

if sl > 0

strategy.order(id = "short order", direction = strategy.short , qty = sl, limit = close, stop = stop_loss_price, comment = "空单", when = open_short_order_conditions)

else if strategy.opentrades == 1

if open_order_type == 1

if close <= stop_loss_price or close >= stop_profit_price

stop_loss_price := float(na)

stop_profit_price := float(na)

lr = (close - open_order_price) * sl

start_price := start_price + lr

strategy.close_all(when = true, comment = "平多")

if open_order_type == 0

if close >= stop_loss_price or close <= stop_profit_price

stop_loss_price := float(na)

stop_profit_price := float(na)

lr = (open_order_price - close) * sl

start_price := start_price + lr

strategy.close_all(when = true, comment = "平空")

// plot(series = current_trend, title = "当前趋势", color = color.orange)

// plot(series = strategy.opentrades, title = "未平单数量", color = color.orange)

// plot(series = open_order_type, title = "开单类型", color = color.orange)

plot(series = open_order_price, title = "开单价", color = color.orange)

plot(series = stop_loss_price, title = "止损价", color = color.orange)

plot(series = stop_profit_price, title = "止盈价", color = color.orange)

// plot(series = sl, title = "开单数量", color = color.orange)

// plot(series = start_price, title = "剩余金额", color = color.orange, style = plot.style_circles)

相关推荐

- 智能MACD策略

- TUE ADX/MACD汇集策略

- RSI和BBand同时超卖

- 带MACD/EMA确认的高低点摆动策略

- 三重EMA和MACD策略

- MACD威利策略

- Midas Mk.II-终极震荡策略

- 基于动量的ZigZag

- 商品期货Python版MACD策略(教学)

- 3EMA + Boullinger + PIVOT 策略

更多内容