我花了很多时间寻找最佳的基于动量的指示信号。所有人的困难在于,他们总是在一些预定义的规则上下注,这些规则可以识别或确认轴心点。通常是时间因素——在特定数量的蜡烛之后,确定轴心点。当市场运行相对缓慢时,这种方法可能是最好的,但当价格开始上下波动时,就不可能准确地遵循之字形。另一方面,如果设置得太紧(例如,仅在2根甚至1根蜡烛后确认枢轴),则会得到数百条锯齿线,它们不会告诉您任何信息。

我的观点是跟随市场。如果已反转,则已反转,无需等待预定义数量的蜡烛进行确认。在动量指标(如最受欢迎的MACD)上,这种逆转总是显而易见的。但一条单行移动平均线也足以引起反转。或者是我最喜欢的一个——QQE,我从JustUncleL那里借来(并改进了),JustUncleL从Glaz那里借来,Glaz从。。。我甚至不知道定量定性估计的来源。感谢所有这些人的投入和代码。

因此,无论你选择哪种动量指标——是的,都有一个“选择你的毒药类型”选择器,就像著名的移动平均线指标一样——一旦它反转,就会捕捉到冲动的最高点(或最低点),并打印出“ZigZag”。

有一件事我需要强调。此指示器不重新绘制。这可能看起来有点延迟,尤其是与TradingView上的所有其他曲折指标相比,但事实上是这样的。这其中有一个价值——我的指示器在被注意到的那一刻准确地打印轴心点和之字形,而不是更早地假装速度比实际速度快。

作为奖励,该指标标记了哪种冲动具有力量。很高兴看到一种前进的冲动,但没有力量——很可能会发生更大的逆转。

我将发布更多基于此之字形算法的脚本,所以请在TradingView上关注我以获得通知。

享受

回测测试

策略源码

/*backtest

start: 2021-02-01 09:00:00

end: 2022-05-22 15:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["ContractType","i888",360008]]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Peter_O

//@version=5

indicator('Momentum-based ZigZag', overlay=true)

var int momentum_direction = 0

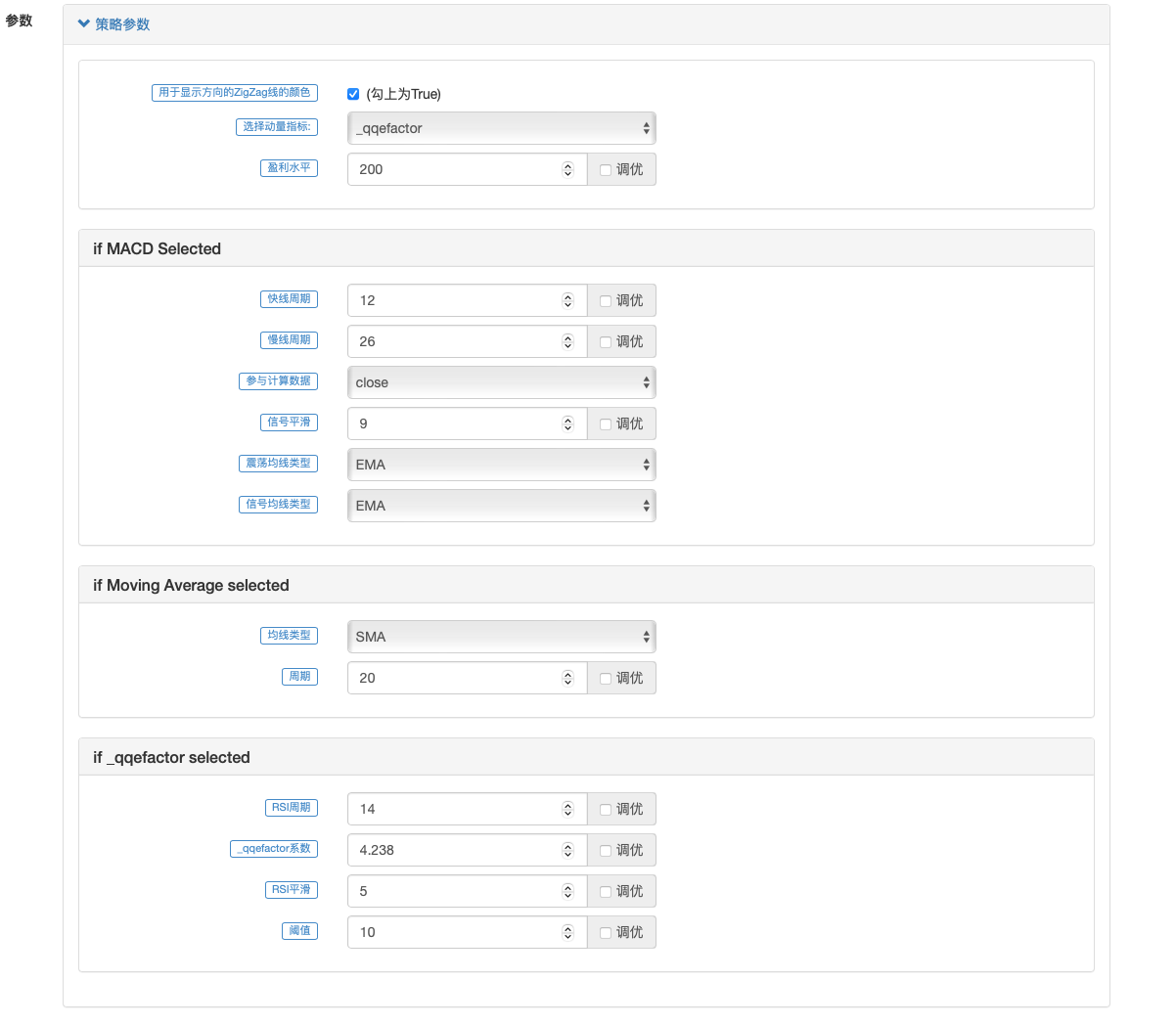

color_zigzag_lines = input(true, title='用于显示方向的ZigZag线的颜色')

momentum_select = input.string(title='选择动量指标:', defval='QQE', options=['MACD', 'MovingAverage', 'QQE'])

// ZigZag function {

zigzag(_momentum_direction) =>

zz_goingup = _momentum_direction == 1

zz_goingdown = _momentum_direction == -1

var float zz_peak = na

var float zz_bottom = na

zz_peak := high > zz_peak[1] and zz_goingup or zz_goingdown[1] and zz_goingup ? high : nz(zz_peak[1])

zz_bottom := low < zz_bottom[1] and zz_goingdown or zz_goingup[1] and zz_goingdown ? low : nz(zz_bottom[1])

zigzag = zz_goingup and zz_goingdown[1] ? zz_bottom[1] : zz_goingup[1] and zz_goingdown ? zz_peak[1] : na

zigzag

// } End of ZigZag function

// MACD {

fast_length = input.int(title='快线周期', defval=12, group='if MACD Selected', inline='macd')

slow_length = input.int(title='慢线周期', defval=26, group='if MACD Selected', inline='macd')

src = input.source(title='参与计算数据', defval=close, group='if MACD Selected', inline='macd')

signal_length = input.int(title='信号平滑', minval=1, maxval=50, defval=9, group='if MACD Selected', inline='macd')

sma_source = input.string(title='震荡均线类型', defval='EMA', options=['SMA', 'EMA'], group='if MACD Selected', inline='macd')

sma_signal = input.string(title='信号均线类型', defval='EMA', options=['SMA', 'EMA'], group='if MACD Selected', inline='macd')

fast_ma = sma_source == 'SMA' ? ta.sma(src, fast_length) : ta.ema(src, fast_length)

slow_ma = sma_source == 'SMA' ? ta.sma(src, slow_length) : ta.ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == 'SMA' ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

macdUP = ta.crossover(macd, signal)

macdDOWN = ta.crossunder(macd, signal)

// } End of MACD

// Moving Averages {

smoothing_type = input.string(title='均线类型', defval='SMA', options=['EMA', 'SMA', 'WMA', 'VWMA', 'HMA', 'RMA', 'DEMA'], inline='movingaverage', group='if Moving Average selected')

ma_length = input.int(20, title='周期', inline='movingaverage', group='if Moving Average selected')

moving_average(_series, _length, _smoothing) =>

_smoothing == 'EMA' ? ta.ema(_series, _length) : _smoothing == 'SMA' ? ta.sma(_series, _length) : _smoothing == 'WMA' ? ta.wma(_series, _length) : _smoothing == 'VWMA' ? ta.vwma(_series, _length) : _smoothing == 'HMA' ? ta.hma(_series, _length) : _smoothing == 'RMA' ? ta.rma(_series, _length) : _smoothing == 'DEMA' ? 2 * ta.ema(_series, _length) - ta.ema(ta.ema(_series, _length), _length) : ta.ema(_series, _length)

movingaverage = moving_average(close, ma_length, smoothing_type)

maUP = movingaverage > movingaverage[1] and movingaverage[2] > movingaverage[1]

maDOWN = movingaverage < movingaverage[1] and movingaverage[2] < movingaverage[1]

// } End of Moving Averages

// QQE {

RSI_Period = input.int(14, title='RSI周期', inline='qqe', group='if QQE selected')

qqeslow = input.float(4.238, title='QQE系数', inline='qqe', group='if QQE selected')

SFslow = input.int(5, title='RSI平滑', inline='qqe', group='if QQE selected')

ThreshHold = input.int(10, title='阈值', inline='qqe', group='if QQE selected')

rsi_currenttf = ta.rsi(close, RSI_Period)

qqenew(_qqefactor, _smoothingfactor, _rsi, _threshold, _RSI_Period) =>

RSI_Period = _RSI_Period

SF = _smoothingfactor

QQE = _qqefactor

ThreshHold = _threshold

Wilders_Period = RSI_Period * 2 - 1

Rsi = _rsi

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

QQExlong = 0

QQExlong := nz(QQExlong[1])

QQExshort = 0

QQExshort := nz(QQExshort[1])

qqe_goingup = ta.barssince(QQExlong == 1) < ta.barssince(QQExshort == 1)

qqe_goingdown = ta.barssince(QQExlong == 1) > ta.barssince(QQExshort == 1)

var float last_qqe_high = high

var float last_qqe_low = low

last_qqe_high := high > last_qqe_high[1] and qqe_goingup or qqe_goingdown[1] and qqe_goingup ? high : nz(last_qqe_high[1])

last_qqe_low := low < last_qqe_low[1] and qqe_goingdown or qqe_goingup[1] and qqe_goingdown ? low : nz(last_qqe_low[1])

trend := ta.crossover(RSIndex, shortband[1]) or ta.crossover(high, last_qqe_high) ? 1 : ta.crossunder(RSIndex, longband[1]) or ta.crossunder(low, last_qqe_low) ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

// Find all the QQE Crosses

QQExlong := trend == 1 and trend[1] == -1 ? QQExlong + 1 : 0

QQExshort := trend == -1 and trend[1] == 1 ? QQExshort + 1 : 0

qqeLong = QQExlong == 1 ? FastAtrRsiTL[1] - 50 : na

qqeShort = QQExshort == 1 ? FastAtrRsiTL[1] - 50 : na

qqenew = qqeLong ? 1 : qqeShort ? -1 : na

qqenew

qqeUP = qqenew(qqeslow, SFslow, rsi_currenttf, ThreshHold, RSI_Period) == 1

qqeDOWN = qqenew(qqeslow, SFslow, rsi_currenttf, ThreshHold, RSI_Period) == -1

// } End of QQE

momentumUP = momentum_select == 'MACD' ? macdUP : momentum_select == 'MovingAverage' ? maUP : momentum_select == 'QQE' ? qqeUP : qqeUP

momentumDOWN = momentum_select == 'MACD' ? macdDOWN : momentum_select == 'MovingAverage' ? maDOWN : momentum_select == 'QQE' ? qqeDOWN : qqeDOWN

momentum_direction := momentumUP ? 1 : momentumDOWN ? -1 : nz(momentum_direction[1])

// { Force detection

rsi5 = ta.rsi(close, 5)

ob = 80

os = 20

barssince_momentumUP = ta.barssince(momentumUP)

barssince_momentumDOWN = ta.barssince(momentumDOWN)

momentum_DOWN_was_force_up = momentumDOWN and (barssince_momentumUP >= ta.barssince(rsi5 > ob))[1]

momentum_UP_was_force_down = momentumUP and (barssince_momentumDOWN >= ta.barssince(rsi5 < os))[1]

zzcolor_rsi5 = momentum_DOWN_was_force_up ? color.lime : momentum_UP_was_force_down ? color.red : color.black

// } End of Force detection

ZigZag = zigzag(momentum_direction)

plot(ZigZag, linewidth=5, color=color_zigzag_lines ? zzcolor_rsi5 : color.black, title='ZIGZAG', style=plot.style_line, transp=0)

GoShort = momentumDOWN and not momentum_DOWN_was_force_up

GoLong = momentumUP and not momentum_UP_was_force_down

if GoShort

label.new(bar_index, ZigZag, style=label.style_label_down, color=color.red, text=str.tostring('SHORT\n\npivot high: \n' + str.tostring(ZigZag)))

if GoLong

label.new(bar_index, ZigZag, style=label.style_label_up, color=color.lime, text=str.tostring('LONG\n\npivot low: \n' + str.tostring(ZigZag)))

var float stoploss_long = low

var float stoploss_short = high

pl = ta.valuewhen(momentumUP, ZigZag, 0)

ph = ta.valuewhen(momentumDOWN, ZigZag, 0)

if GoLong

stoploss_long := low < pl ? low : pl

stoploss_long

if GoShort

stoploss_short := high > ph ? high : ph

stoploss_short

TakeProfitLevel=input(200, title='盈利水平')

if GoLong

alertsyntax_golong = 'long slprice=' + str.tostring(stoploss_long) + ' tp=' + str.tostring(TakeProfitLevel)

alert(message=alertsyntax_golong, freq=alert.freq_once_per_bar_close)

if GoShort

alertsyntax_goshort = 'short slprice=' + str.tostring(stoploss_short) + ' tp=' + str.tostring(TakeProfitLevel)

alert(message=alertsyntax_goshort, freq=alert.freq_once_per_bar_close)

if GoLong

strategy.entry("Enter Long", strategy.long)

else if GoShort

strategy.entry("Enter Short", strategy.short)

相关推荐