策略回测

策略源码

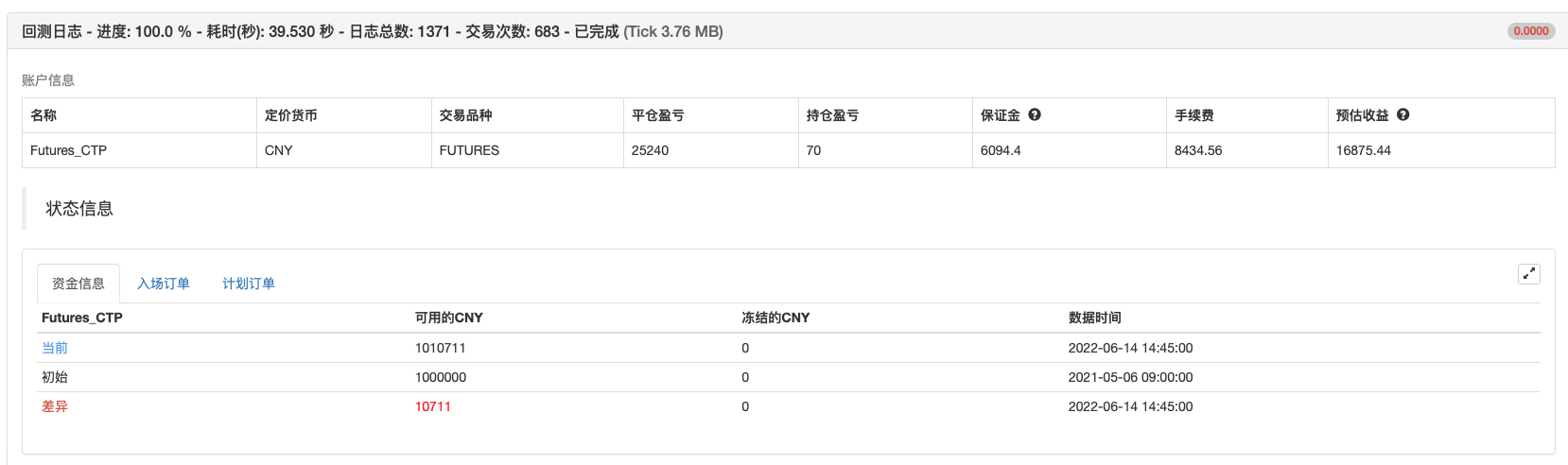

/*backtest

start: 2021-05-01 09:00:00

end: 2022-06-14 15:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["ContractType","rb888",360008]]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © colinmck

//@version=4

study(title="Twin Range Filter", overlay=true)

source = input(defval=close, title="数据源")

// Smooth Average Range

per1 = input(defval=27, minval=1, title="快线 周期")

mult1 = input(defval=1.6, minval=0.1, title="快线 范围")

per2 = input(defval=55, minval=1, title="慢线 周期")

mult2 = input(defval=2, minval=0.1, title="慢线 范围")

smoothrng(x, t, m) =>

wper = t * 2 - 1

avrng = ema(abs(x - x[1]), t)

smoothrng = ema(avrng, wper) * m

smoothrng

smrng1 = smoothrng(source, per1, mult1)

smrng2 = smoothrng(source, per2, mult2)

smrng = (smrng1 + smrng2) / 2

// Range Filter

rngfilt(x, r) =>

rngfilt = x

rngfilt := x > nz(rngfilt[1]) ? x - r < nz(rngfilt[1]) ? nz(rngfilt[1]) : x - r :

x + r > nz(rngfilt[1]) ? nz(rngfilt[1]) : x + r

rngfilt

filt = rngfilt(source, smrng)

upward = 0.0

upward := filt > filt[1] ? nz(upward[1]) + 1 : filt < filt[1] ? 0 : nz(upward[1])

downward = 0.0

downward := filt < filt[1] ? nz(downward[1]) + 1 : filt > filt[1] ? 0 : nz(downward[1])

hband = filt + smrng

lband = filt - smrng

longCond = bool(na)

shortCond = bool(na)

longCond := source > filt and source > source[1] and upward > 0 or source > filt and source < source[1] and upward > 0

shortCond := source < filt and source < source[1] and downward > 0 or source < filt and source > source[1] and downward > 0

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

long = longCond and CondIni[1] == -1

short = shortCond and CondIni[1] == 1

// Plotting

plotshape(long, title="Long", text="Long", style=shape.labelup, textcolor=color.black, size=size.tiny, location=location.belowbar, color=color.lime, transp=0)

plotshape(short, title="Short", text="Short", style=shape.labeldown, textcolor=color.white, size=size.tiny, location=location.abovebar, color=color.red, transp=0)

// Alerts

alertcondition(long, title="Long", message="Long")

alertcondition(short, title="Short", message="Short")

if long

strategy.entry("buy", strategy.long)

else if short

strategy.entry("sell", strategy.short)

相关推荐