高频交易分类

- 以最快的速度抹平市场的一切不合理现象, 常见于炒单与高频套利, 主动出击, 拼速度

- 提前在不合理的价位埋伏并跟随市场快速移动, 常见于市商策略, 守株待兔, 拼知识面

- 其它各种作者只学习了理论没有实盘, 先不讲

动手实现

- 观察盘口的概率极低的不合理现像并做出相应策略进行测试更改

- 如果逻辑复杂, 就需要利用现有的数学知识尽可能的用模型描述不合理现象的本质, 尽量减少拟合

- 必须用可以见量成交又可以见价成交的回测模型去验证, 发明者量化目前是唯一支持这两种回测模式的平台

- 平台的C++例子很少, 这里就用C++写本策略, 方便大家学习

策略原理

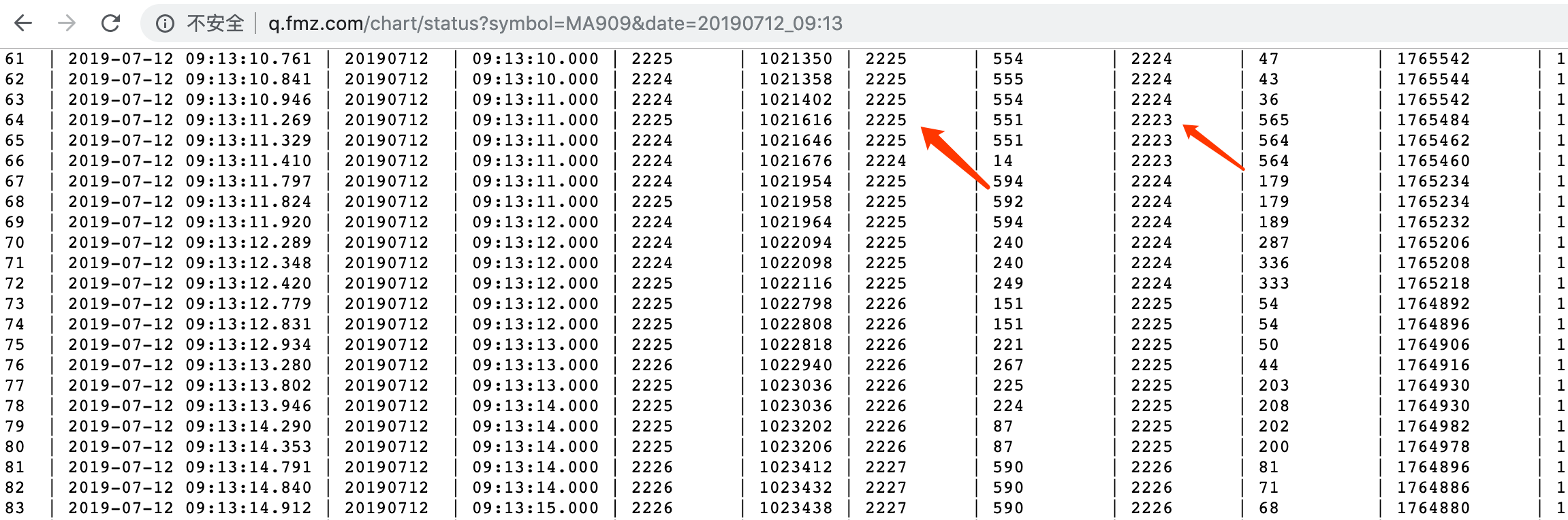

正常情况下商品期货的盘口买一卖一差价只有一跳, 偶尔会有两跳,三跳基本很少见, 主力合约交易比较频繁, 这种现像发生后瞬间消失, 难以有下手机会, 我们就把精力放到次主力合约上面,比如MA001为主力, MA909为次主力时, MA909盘口下面这种情况

卖一为2225量551, 买一2223量565, 向下看几秒, 出现这种情况后, 几个tick推送后消失, 这种情况,我们视为市场的自我纠正, 我们要做的就是赶在市场主动纠正前, 杀进去, 这种逻辑看人工去盯盘是天方夜谈, 因为商品期货盘口差价两跳的情况级少出现, 三跳最安全, 但三跳极少出现, 导致交易频率太低, 意义不大, 接下来, 我们观察盘口之前卖一买一与现在两跳时买一卖一的区别, 去填补盘口差价空隙, 如果速度够快, 就可以排在委托单的最前位置, 做为Maker以最快的速度成交后反手卖出, 持仓时间很短, 有了这个交易逻辑, 实现为策略以后, 以MA909为例, 实盘测试推荐易盛而非CTP接口, 易盛仓位与资金变化是推送机制, 非常适合高频

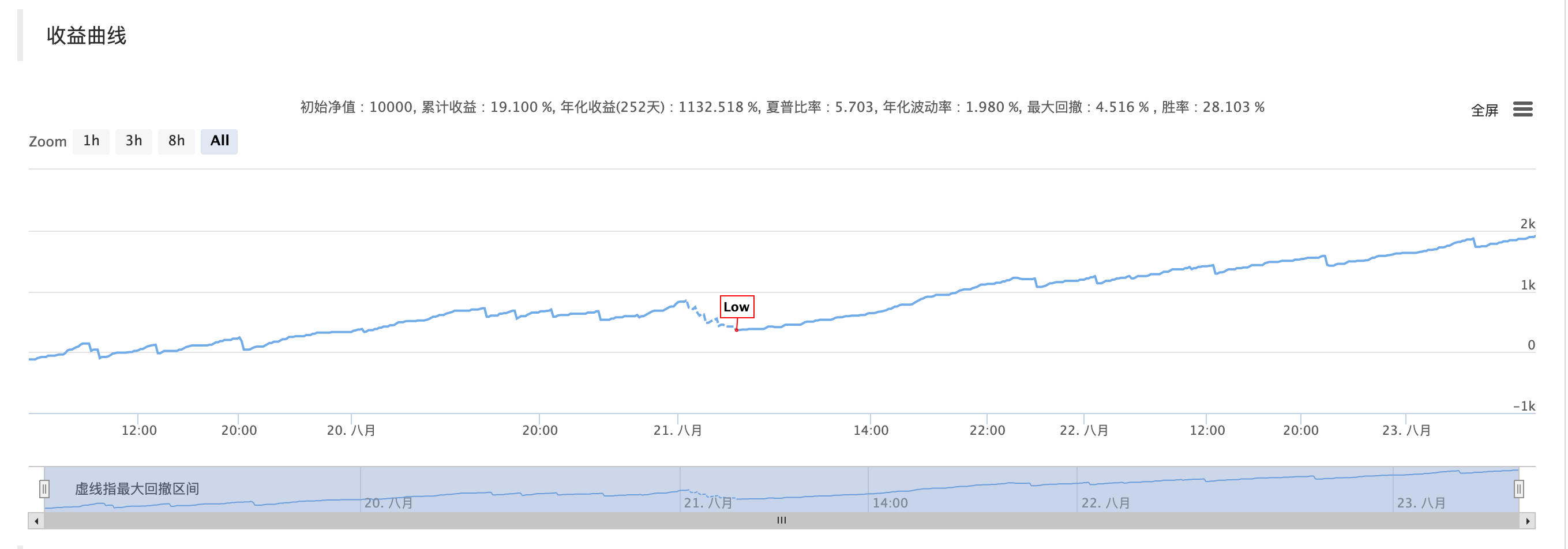

回测结果

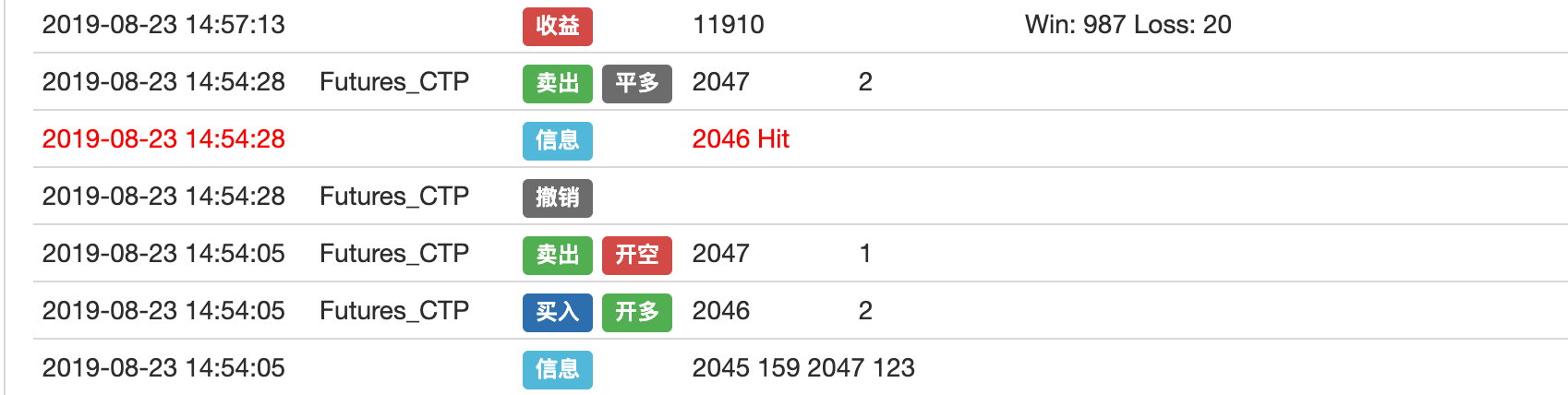

交易逻辑

必看声明

为满足对高频交易的好奇心, 为了更明显的看到结果, 此策略回测手续费设定为0, 实现了一个简单的拼速度逻辑, 想要覆盖手续费实现盈利, 实盘需做更多优化, 仅凭这个简单的逻辑很难致胜, 要考虑更多操作, 比如锁仓(降低平今手续费), 利用定单薄流进行短期预测提高胜率, 再加上交易所手续费返还, 从而实现一个可持久盈利的策略, 关于高频交易的书籍很多, 希望大家多去思考,多去实盘,而不是只停留在原理上.

关于我们

发明者量化是一个纯技术驱动的团队, 为量化交易爱好者提供了一个高可用的回测机制, 我们的回测机制是真实的模拟了一个交易所的存在, 而不是简单的见价撮合, 希望用户能够利用到平台的优点更好的去发挥自己的能力

/*backtest

start: 2019-08-19 09:00:00

end: 2019-08-23 15:00:00

period: 1m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES","balance":20000,"minfee":0,"fee":[0,0]}]

mode: 1

*/

enum State {

STATE_NA,

STATE_IDLE,

STATE_HOLD_LONG,

STATE_HOLD_SHORT,

};

typedef struct {

double bidPrice;

double bidAmount;

double askPrice;

double askAmount;

} Book;

class HFT {

public:

HFT() {

_tradingDay = getTradingWeekDay();

Log("current trading weekday", _tradingDay);

}

int getTradingWeekDay() {

int seconds = Unix() + 28800;

int hour = (seconds/3600)%24;

int weekDay = (seconds/(60*60*24)+4)%7;

if (hour > 20) {

weekDay += 1;

}

return weekDay;

}

State getState() {

auto orders = exchange.GetOrders();

if (!orders.Valid || orders.size() == 2) {

return STATE_NA;

}

bool foundCover = false;

for (auto &order : orders) {

if (order.Id == _coverId) {

if ((order.Type == ORDER_TYPE_BUY && order.Price < _book.bidPrice - _toleratePrice) ||

(order.Type == ORDER_TYPE_SELL && order.Price > _book.askPrice + _toleratePrice)) {

exchange.CancelOrder(order.Id, "Cancel Cover Order");

_countCancel++;

_countRetry++;

} else {

foundCover = true;

}

} else {

exchange.CancelOrder(order.Id);

_countCancel++;

}

}

if (foundCover) {

return STATE_NA;

}

auto positions = exchange.GetPosition();

if (!positions.Valid) {

return STATE_NA;

}

for (auto &pos : positions) {

if (pos.ContractType == Symbol) {

_holdPrice = pos.Price;

_holdAmount = pos.Amount;

_holdType = pos.Type;

return pos.Type == PD_LONG || pos.Type == PD_LONG_YD ? STATE_HOLD_LONG : STATE_HOLD_SHORT;

}

}

return STATE_IDLE;

}

void stop() {

Log(exchange.GetOrders());

Log(exchange.GetPosition());

Log("Stop");

}

bool Loop() {

if (exchange.IO("status") == 0) {

LogStatus(_D(), "Server not connect ....");

Sleep(1000);

return true;

}

if (_initBalance == 0) {

_initBalance = _C(exchange.GetAccount).Balance;

}

auto day = getTradingWeekDay();

if (day != _tradingDay) {

_tradingDay = day;

_countCancel = 0;

}

if (_ct.is_null()) {

Log(_D(), "subscribe", Symbol);

_ct = exchange.SetContractType(Symbol);

if (!_ct.is_null()) {

auto obj = _ct["Commodity"]["CommodityTickSize"];

int volumeMultiple = 1;

if (obj.is_null()) { // CTP

obj = _ct["PriceTick"];

volumeMultiple = _ct["VolumeMultiple"];

_exchangeId = _ct["ExchangeID"];

} else { // Esunny

volumeMultiple = _ct["Commodity"]["ContractSize"];

_exchangeId = _ct["Commodity"]["ExchangeNo"];

}

if (obj.is_null() || obj <= 0) {

Panic("PriceTick not found");

}

if (_priceTick < 1) {

exchange.SetPrecision(1, 0);

}

_priceTick = double(obj);

_toleratePrice = _priceTick * TolerateTick;

_ins = _ct["InstrumentID"];

Log(_ins, _exchangeId, "PriceTick:", _priceTick, "VolumeMultiple:", volumeMultiple);

}

Sleep(1000);

return true;

}

// Check orders and positions to set state

auto depth = exchange.GetDepth();

if (!depth.Valid) {

LogStatus(_D(), "Market not ready");

Sleep(1000);

return true;

}

_countTick++;

_preBook = _book;

_book.bidPrice = depth.Bids[0].Price;

_book.bidAmount = depth.Bids[0].Amount;

_book.askPrice = depth.Asks[0].Price;

_book.askAmount = depth.Asks[0].Amount;

// _book not init

if (_preBook.bidAmount == 0) {

return true;

}

auto st = getState();

LogStatus(_D(), _ins, "State:", st,

"Ask:", depth.Asks[0].Price, depth.Asks[0].Amount,

"Bid:", depth.Bids[0].Price, depth.Bids[0].Amount,

"Cancel:", _countCancel,

"Tick:", _countTick);

bool forceCover = _countRetry >= _retryMax;

if (st == STATE_IDLE) {

if (_holdAmount > 0) {

if (_countRetry > 0) {

_countLoss++;

} else {

_countWin++;

}

auto account = exchange.GetAccount();

if (account.Valid) {

LogProfit(_N(account.Balance+account.FrozenBalance-_initBalance, 2), "Win:", _countWin, "Loss:", _countLoss);

}

}

_countRetry = 0;

_holdAmount = 0;

if (_countCancel > _cancelMax) {

Log("Cancel Exceed", _countCancel);

return false;

}

bool canDo = false;

if (abs(_book.bidPrice - _book.askPrice) > _priceTick * 1) {

canDo = true;

}

if (!canDo) {

return true;

}

auto bidPrice = depth.Bids[0].Price;

auto askPrice = depth.Asks[0].Price;

auto bidAmount = 1.0;

auto askAmount = 1.0;

if (_preBook.bidPrice > _book.bidPrice && _book.askAmount < _book.bidAmount) {

bidPrice += _priceTick;

bidAmount = 2;

} else if (_preBook.askPrice < _book.askPrice && _book.bidAmount < _book.askAmount) {

askPrice -= _priceTick;

askAmount = 2;

} else {

return true;

}

Log(_book.bidPrice, _book.bidAmount, _book.askPrice, _book.askAmount);

exchange.SetDirection("buy");

exchange.Buy(bidPrice, bidAmount);

exchange.SetDirection("sell");

exchange.Sell(askPrice, askAmount);

} else if (st == STATE_HOLD_LONG) {

exchange.SetDirection((_holdType == PD_LONG && _exchangeId == "SHFE") ? "closebuy_today" : "closebuy");

auto sellPrice = depth.Asks[0].Price;

if (sellPrice > _holdPrice) {

Log(_holdPrice, "Hit #ff0000");

sellPrice = _holdPrice + ProfitTick;

} else if (sellPrice < _holdPrice) {

forceCover = true;

}

if (forceCover) {

Log("StopLoss");

}

_coverId = exchange.Sell(forceCover ? depth.Bids[0].Price : sellPrice, _holdAmount);

if (!_coverId.Valid) {

return false;

}

} else if (st == STATE_HOLD_SHORT) {

exchange.SetDirection((_holdType == PD_SHORT && _exchangeId == "SHFE") ? "closesell_today" : "closesell");

auto buyPrice = depth.Bids[0].Price;

if (buyPrice < _holdPrice) {

Log(_holdPrice, "Hit #ff0000");

buyPrice = _holdPrice - ProfitTick;

} else if (buyPrice > _holdPrice) {

forceCover = true;

}

if (forceCover) {

Log("StopLoss");

}

_coverId = exchange.Buy(forceCover ? depth.Asks[0].Price : buyPrice, _holdAmount);

if (!_coverId.Valid) {

return false;

}

}

return true;

}

private:

double _holdPrice = 0;

double _holdAmount = 0;

int _holdType;

int _countTick = 0;

int _countRetry = 0;

int _countCancel = 0;

int _period = 20;

int _tradingDay = 0;

double _initBalance;

const int _retryMax = RetryMax;

const int _cancelMax = 300;

int _countLoss = 0;

int _countWin = 0;

json _ct;

string _ins;

string _exchangeId;

double _priceTick;

double _toleratePrice;

Book _book;

Book _preBook;

TId _coverId;

};

void main() {

LogReset();

SetErrorFilter("ready|timeout");

Log("Init OK");

HFT hft;

while (hft.Loop());

Log("Exit");

}