Overview

The SSL Channel Dual-Tranche Profit Strategy is a quantitative trading system based on the SSL Channel (Semantic SSL Channel) indicator, combining trend following with sophisticated position management methods. The core of this strategy is to determine market trend direction through SSL channel crossover signals and enter trades when trends reverse. Its distinctive feature is the dual-tranche exit mechanism—dividing positions into two parts: the first part exits at a fixed profit target, while the second part is managed through a trailing stop to maximize capture of trending markets. Additionally, the strategy integrates the Average True Range (ATR) indicator for dynamic risk management, making risk control more precise and adaptable to changes in market volatility.

Strategy Principles

The technical principles of the SSL Channel Dual-Tranche Profit Strategy include the following key components:

SSL Channel Construction: The strategy first calculates Simple Moving Averages (SMAs) of high and low prices, which serve as the foundation for the SSL channel. By setting a trend state variable Hlv (based on the relationship between closing price and high/low SMAs), it determines the positions of the upper and lower channel lines.

Trend Identification Mechanism: When the closing price breaks above the high price SMA, the Hlv value is set to 1 (uptrend); when the closing price falls below the low price SMA, the Hlv value is set to -1 (downtrend). The strategy generates a buy signal when Hlv changes from -1 to 1, and a sell signal when Hlv changes from 1 to -1.

Dual-Tranche Exit System:

- First tranche (50% position): Sets a fixed profit target of 1x ATR

- Second tranche (remaining 50%): After the first tranche is achieved, initially moves the stop-loss to entry price (breakeven), and activates a trailing stop mechanism when the price reaches 2x ATR profit

Dynamic Risk Management:

- Sets initial stop-loss at 1.5x ATR at entry

- Moves stop-loss to breakeven after first tranche profit

- Implements ATR-based trailing stop (tracking highest/lowest points minus/plus 1x ATR) after further price breakout

Trend Reversal Protection: Regardless of whether price reaches stop-loss or take-profit conditions, when the SSL channel flips (generating an opposite signal), the strategy immediately closes positions to protect existing profits.

Strategy Advantages

Through in-depth analysis of the code, this strategy demonstrates multiple advantages:

Trend Capture Capability: The strategy effectively identifies market trend turning points using the SSL Channel indicator, capturing the initial phase of trends in a timely manner while quickly exiting during trend reversals to avoid drawdowns.

Risk Diversification Mechanism: The dual-tranche exit design strikes a balance between conservative and aggressive approaches, both locking in partial profits and maximizing the capture of extended trends.

Dynamic Adaptation to Market Volatility: By integrating the ATR indicator, the strategy automatically adjusts stop-loss and take-profit levels according to actual market volatility, maintaining good performance in different volatility environments.

Flexible Capital Management: The 50% position stage management method both ensures stable returns and creates conditions for maximizing potential profits, enabling the strategy to remain competitive in different market environments.

Adaptive Protection Mechanism: As prices move favorably, the trailing stop system automatically elevates protection levels, ensuring that most gains are preserved when the market reverses.

Clear Entry and Exit Logic: The strategy’s signal system is concise and straightforward, avoiding excessive optimization and complex parameter settings, enhancing the reliability and stability of the strategy in live trading environments.

Strategy Risks

Despite its sophisticated design, the strategy still has the following potential risks and limitations:

Poor Performance in Ranging Markets: As a trend-following strategy, it may generate frequent false signals in sideways consolidating markets, leading to consecutive losing trades. Solution: Consider adding range-bound indicators to filter signals, or pause trading during consolidation phases.

Fixed ATR Multiplier Risk: The strategy uses fixed ATR multipliers for setting stop-losses and take-profits, which may not be flexible enough in extreme market conditions. Solution: Consider dynamically adjusting ATR multipliers based on historical volatility percentiles, or adding volatility adaptation mechanisms.

Lack of Market Environment Filtering: The strategy does not differentiate between different market environments, potentially continuing to trade during phases unsuitable for trend following. Solution: Introduce market environment classification indicators, such as ADX or volatility indicators, to reduce trading frequency in low trend-strength environments.

Early Exit Risk for First Tranche: The fixed 1x ATR profit target may exit 50% of the position too early in strong trends, reducing overall returns. Solution: Consider dynamically adjusting the first tranche profit target based on trend strength.

Lack of Position Sizing Optimization: The code lacks a mechanism to adjust position size based on risk, potentially leading to unbalanced risk exposure. Solution: Introduce volatility-based position size calculations to ensure consistent risk exposure for each trade.

Strategy Optimization Directions

Based on code analysis, here are improvement directions for the strategy:

Add Market Filtering Conditions: Introduce ADX (Average Directional Index) or similar indicators to measure trend strength, trading only in obvious trending market environments to avoid false signals in ranging markets. This can significantly improve signal quality and overall win rate.

Dynamic Adjustment of ATR Multipliers: Automatically adjust ATR multipliers based on historical volatility levels, using larger multipliers in low-volatility environments and smaller multipliers in high-volatility environments to adapt to different market conditions.

Optimize First Tranche Exit Mechanism: Consider reducing the exit proportion of the first tranche after strong trend confirmation (such as when trend duration or strength reaches specific thresholds), or setting dynamic exit targets rather than a fixed 50%.

Incorporate Multi-Timeframe Confirmation: Integrate trend direction from longer timeframes as filtering conditions to ensure trading in the direction of the main trend, improving success rates.

Introduce Volume Confirmation: Use volume as an additional confirmation indicator, only confirming trend change signals when volume increases, reducing false breakouts.

Optimize Trailing Stop Mechanism: The current trailing stop is based on closing prices; consider using more professional trailing stop systems such as Chandelier Exit or Parabolic SAR to improve the sensitivity and precision of stops.

Seasonality and Time Filtering: Analyze strategy performance across different time periods and seasonal cycles, increasing position size during historically best-performing periods, or only trading during specific time periods.

Summary

The SSL Channel Dual-Tranche Profit Strategy is a comprehensive trading system combining technical indicators with sophisticated position management. Its core strengths lie in effective trend capture capability and risk control mechanisms, particularly the dual-tranche exit system design, which achieves a good balance between protecting capital safety and maximizing trend returns.

By using the SSL Channel indicator as a trend identification tool, combined with an ATR dynamic risk management system, the strategy can adapt to volatility changes under different market conditions. The dual-tranche exit design not only provides a stable profit-locking mechanism but also retains the possibility of capturing major trends.

Although it may face challenges in ranging market environments, there is significant room for improvement through introducing trend strength filtering, optimizing ATR parameter settings, and improving trailing stop mechanisms. Particularly, adding multi-timeframe confirmation and volume analysis can further enhance signal quality and overall win rate.

Overall, the SSL Channel Dual-Tranche Profit Strategy demonstrates the core elements of quantitative trading system design: clear entry and exit rules, systematic risk management, and the ability to adapt to market changes. For traders seeking trend-following strategies, this strategy provides a solid foundational framework upon which further customization and optimization can be built according to individual risk preferences and trading objectives.

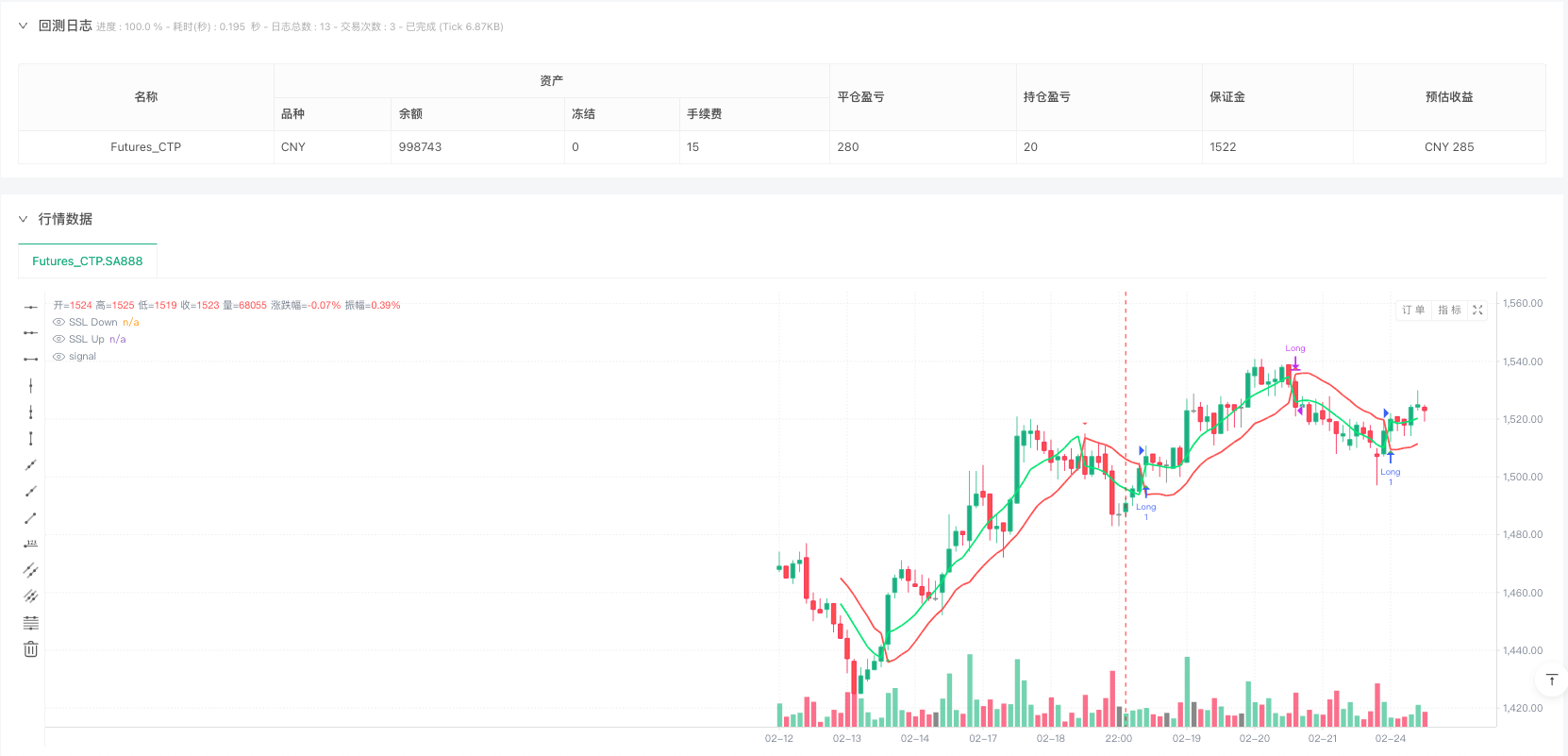

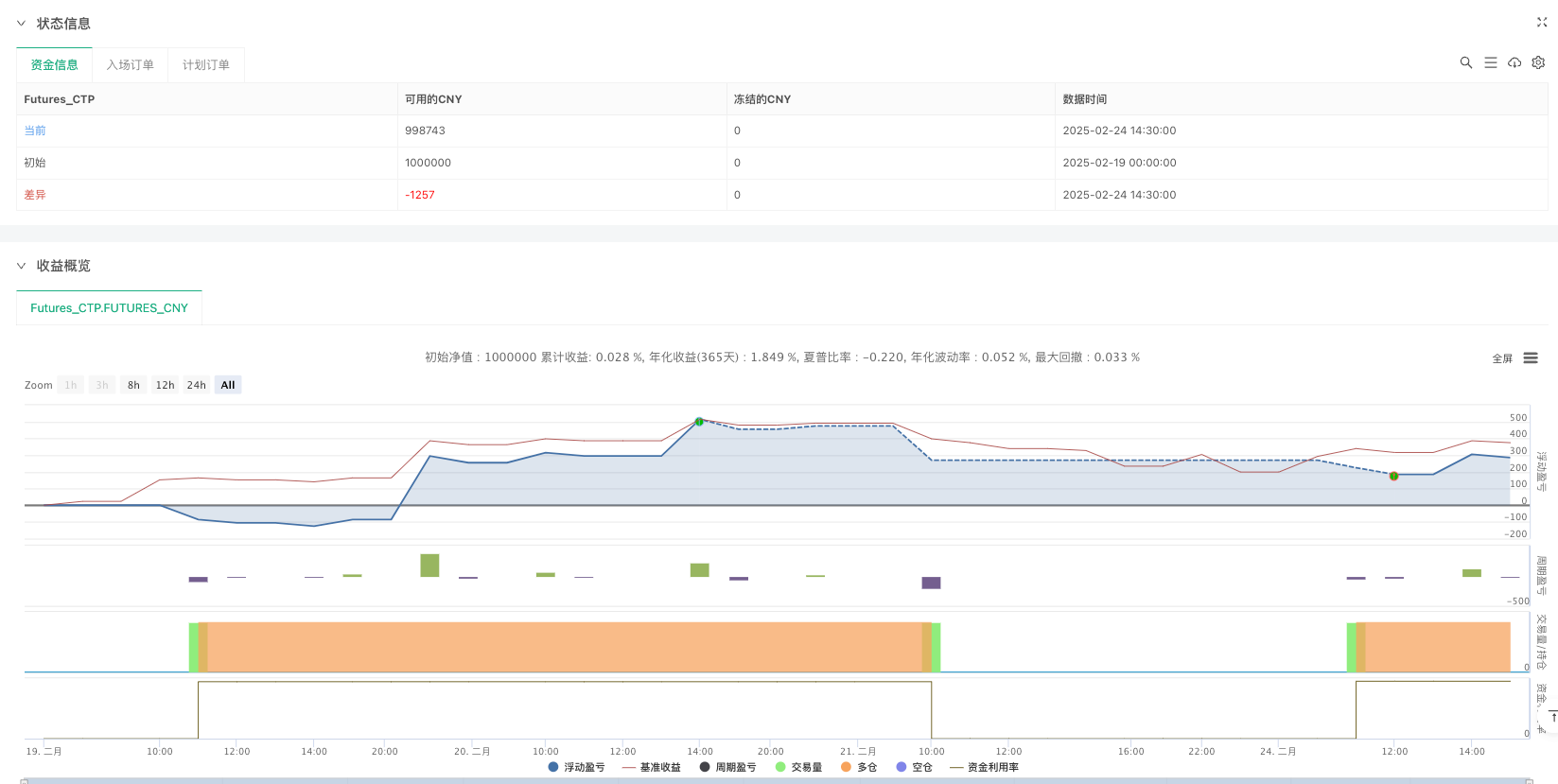

/*backtest

start: 2025-02-19 00:00:00

end: 2025-02-24 15:00:00

period: 30m

basePeriod: 30m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["ContractType","SA888",360008]]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AlanCaoShengJin

//@version=5

strategy("SSL Channel Strategy with Two-Tranche Exits", overlay=true)

// Inputs

len = input.int(10, title="Period")

atrPeriod = input.int(14, title="ATR Period")

// Calculate SMAs and ATR

smaHigh = ta.sma(high, len)

smaLow = ta.sma(low, len)

atrValue = ta.atr(atrPeriod)

// Trend state (Hlv)

var int Hlv = na

Hlv := close > smaHigh ? 1 : close < smaLow ? -1 : Hlv[1]

// SSL channel lines

sslDown = Hlv < 0 ? smaHigh : smaLow

sslUp = Hlv < 0 ? smaLow : smaHigh

// Plot SSL lines

plot(sslDown, title="SSL Down", color=color.red, linewidth=2)

plot(sslUp, title="SSL Up", color=color.lime, linewidth=2)

// Trading signals

buySignal = Hlv[1] == -1 and Hlv == 1

sellSignal = Hlv[1] == 1 and Hlv == -1

// Plot signals for debugging

plotshape(buySignal, title="Buy Signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(sellSignal, title="Sell Signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Variables for long trade management

var float longEntryPrice = na

var float longAtrAtEntry = na

var float longEntryQty = na

var bool longFirstTrancheTaken = false

var float longTrailingStopPrice = na

var int longTrailingStartBar = na

// Variables for short trade management

var float shortEntryPrice = na

var float shortAtrAtEntry = na

var float shortEntryQty = na

var bool shortFirstTrancheTaken = false

var float shortTrailingStopPrice = na

var int shortTrailingStartBar = na

// Reset variables when no position is open

if strategy.position_size == 0

longEntryPrice := na

longAtrAtEntry := na

longEntryQty := na

longFirstTrancheTaken := false

longTrailingStopPrice := na

longTrailingStartBar := na

shortEntryPrice := na

shortAtrAtEntry := na

shortEntryQty := na

shortFirstTrancheTaken := false

shortTrailingStopPrice := na

shortTrailingStartBar := na

// **Long Trade Logic**

// Entry for long trades

if buySignal and strategy.position_size == 0

strategy.entry("Long", strategy.long)

longEntryPrice := close

longAtrAtEntry := atrValue

longEntryQty := strategy.position_size

longFirstTrancheTaken := false

longTrailingStartBar := na

// Set take-profit for first tranche (50%) at 1x ATR

strategy.exit("Long TP1", "Long", limit=longEntryPrice + longAtrAtEntry, qty=longEntryQty / 2)

// Set initial stop-loss at 1.5x ATR below entry

strategy.exit("Long SL", "Long", stop=longEntryPrice - 1.5 * longAtrAtEntry)

// Manage long trade

if strategy.position_size > 0

// Detect if first tranche has been taken

if not longFirstTrancheTaken and strategy.position_size < longEntryQty

longFirstTrancheTaken := true

// Move stop-loss to breakeven

strategy.exit("Long SL", "Long", stop=longEntryPrice)

// Add a label for debugging

label.new(bar_index, high, "First Tranche Taken", color=color.blue, style=label.style_label_down)

// After first tranche, manage the remaining 50%

if longFirstTrancheTaken

// Initiate trailing stop at 2x ATR

if close >= longEntryPrice + 2 * longAtrAtEntry and na(longTrailingStartBar)

longTrailingStartBar := bar_index

// Add a label for debugging

label.new(bar_index, high, "Trailing Stop Initiated", color=color.purple, style=label.style_label_down)

// Update trailing stop

if not na(longTrailingStartBar)

highestCloseSinceTrail = ta.highest(close, bar_index - longTrailingStartBar + 1)

longTrailingStopPrice := highestCloseSinceTrail - longAtrAtEntry

strategy.exit("Long SL", "Long", stop=longTrailingStopPrice)

// Exit long trade on SSL channel flip

if strategy.position_size > 0 and sellSignal

strategy.close("Long", comment="SSL Flip")

// **Short Trade Logic**

// Entry for short trades

if sellSignal and strategy.position_size == 0

strategy.entry("Short", strategy.short)

shortEntryPrice := close

shortAtrAtEntry := atrValue

shortEntryQty := strategy.position_size

shortFirstTrancheTaken := false

shortTrailingStartBar := na

// Set take-profit for first tranche (50%) at 1x ATR below entry

strategy.exit("Short TP1", "Short", limit=shortEntryPrice - shortAtrAtEntry, qty=math.abs(shortEntryQty) / 2)

// Set initial stop-loss at 1.5x ATR above entry

strategy.exit("Short SL", "Short", stop=shortEntryPrice + 1.5 * shortAtrAtEntry)

// Manage short trade

if strategy.position_size < 0

// Detect if first tranche has been taken

if not shortFirstTrancheTaken and strategy.position_size > shortEntryQty

shortFirstTrancheTaken := true

// Move stop-loss to breakeven

strategy.exit("Short SL", "Short", stop=shortEntryPrice)

// Add a label for debugging

label.new(bar_index, low, "First Tranche Taken", color=color.blue, style=label.style_label_up)

// After first tranche, manage the remaining 50%

if shortFirstTrancheTaken

// Initiate trailing stop at 2x ATR

if close <= shortEntryPrice - 2 * shortAtrAtEntry and na(shortTrailingStartBar)

shortTrailingStartBar := bar_index

// Add a label for debugging

label.new(bar_index, low, "Trailing Stop Initiated", color=color.purple, style=label.style_label_up)

// Update trailing stop

if not na(shortTrailingStartBar)

lowestCloseSinceTrail = ta.lowest(close, bar_index - shortTrailingStartBar + 1)

shortTrailingStopPrice := lowestCloseSinceTrail + shortAtrAtEntry

strategy.exit("Short SL", "Short", stop=shortTrailingStopPrice)

// Exit short trade on SSL channel flip

if strategy.position_size < 0 and buySignal

strategy.close("Short", comment="SSL Flip")