## Overview

This strategy is a quantitative trading system based on the Supertrend indicator, combined with precise risk management mechanisms. The core of the strategy uses the crossover relationship between price and the Supertrend line to determine entry timing, while setting a 1% take profit and 1% stop loss for each trade, achieving precise control of risk and reward. The Supertrend indicator is calculated using the Average True Range (ATR) and a custom factor, effectively identifying market trend changes, helping traders enter at the early stages of trend formation and exit promptly when trends reverse, thereby improving the success rate and stability of trades.

Strategy Principles

The core principles of this strategy are based on the calculation and application of the Supertrend indicator:

Supertrend Indicator Calculation:

- The strategy first calculates the Average True Range (ATR), with a default period of 14

- Multiplies the ATR by a custom factor (default 3.0) to obtain the volatility band width

- Calculates the Supertrend line based on price and volatility band width

Entry Signal Generation:

- Long signal: When price crosses above the Supertrend line (ta.crossover function)

- Short signal: When price crosses below the Supertrend line (ta.crossunder function)

Risk Management Mechanism:

- Long trades: 1% stop loss below entry price, 1% take profit above entry price

- Short trades: 1% stop loss above entry price, 1% take profit below entry price

- Implements automatic stop loss and take profit using the stop and limit parameters of the strategy.entry function

Visual Assistance:

- Plots the Supertrend line on the chart to help identify current trend direction

- Displays stop loss and take profit levels, increasing trade visualization

This strategy is written in Pine Script 5.0, using the ta.supertrend function to directly obtain Supertrend indicator values and direction, simplifying code structure and improving computational efficiency.

Strategy Advantages

Trend Following Advantages:

- The Supertrend indicator effectively identifies market trends, reducing losses from false breakouts

- The indicator has strong noise filtering capability, improving signal quality

Precise Risk Management:

- Fixed percentage stop loss and take profit settings make risk control more precise and consistent

- Risk for each trade can be calculated in advance, facilitating capital management

Adjustable Parameters:

- ATR period and multiplier factor can be adjusted according to different market conditions

- Take profit and stop loss percentages can be customized according to individual risk preferences and market volatility

Visualized Trading Process:

- Intuitively displays Supertrend line, take profit, and stop loss levels on the chart

- Enhances transparency and confidence in trading decisions

Concise and Efficient Code:

- Utilizes built-in functions of Pine Script 5.0, with clear code structure

- Calculation logic is intuitive, easy to understand and maintain

Strategy Risks

Range-Bound Market Risk:

- In sideways markets, frequent price crossovers of the Supertrend line may lead to consecutive losses

- Solution: Add filtering conditions, such as combining directional indicators (like ADX) to confirm trend strength

Fixed Percentage Risk:

- 1% stop loss and take profit may be too large or too small in markets with different volatility

- Solution: Dynamically link stop loss and take profit percentages with market volatility (such as ATR)

Trend Reversal Delay:

- The Supertrend indicator is a lagging indicator and may not signal promptly at the beginning of trend reversals

- Solution: Combine leading indicators such as momentum indicators to optimize entry timing

Parameter Sensitivity:

- The selection of ATR period and multiplier factor has a significant impact on strategy performance

- Solution: Conduct comprehensive parameter optimization and backtesting to find the most suitable parameter combinations for specific markets

Close Take Profit Level:

- 1% take profit may lock in profits too early, missing out on benefits from major trends

- Solution: Implement trailing stop loss or partial take profit strategies, retaining some positions to follow trends

Strategy Optimization Directions

Dynamic Stop Loss and Take Profit:

- Change the fixed 1% stop loss and take profit to ATR-based dynamic levels

- Optimization rationale: Better adapt risk management to market volatility, improving strategy adaptability

Multi-Period Confirmation:

- Add trend confirmation mechanisms from higher timeframes

- Optimization rationale: Reduce false signals, improve trade quality, avoid operating against the main trend

Intelligent Position Management:

- Dynamically adjust position size based on market volatility and signal strength

- Optimization rationale: Increase risk exposure when high-confidence signals appear, improving capital utilization efficiency

Add Filtering Conditions:

- Combine volume, momentum indicators, or volatility indicators to filter trading signals

- Optimization rationale: Reduce low-quality signals, improve strategy stability and win rate

Optimize Supertrend Parameters:

- Implement adaptive parameter adjustment mechanisms, dynamically adjusting ATR period and multiplier based on market conditions

- Optimization rationale: Improve the indicator’s adaptability to different market environments, reduce overfitting risk

Summary

The “Multi-Period Supertrend Percentage Risk Management Strategy” is a quantitative trading system that combines trend following with precise risk management. The strategy captures market trend changes through the Supertrend indicator and controls risk using fixed percentage take profit and stop loss levels.

The main advantages of this strategy include clear operational rules, controllable risk, and adjustable parameters, making it suitable for use as a basic trading system. At the same time, the strategy also has disadvantages such as poor performance in oscillating markets and inflexible fixed percentage risk.

To further enhance strategy performance, consider introducing dynamic stop loss and take profit, multi-period confirmation, intelligent position management, and other optimization measures. Through these improvements, the strategy has the potential to further increase win rate and risk-adjusted returns while maintaining its original advantages.

This strategy is suitable for medium to long-term trend traders, especially those who value risk management and pursue stable returns. With reasonable parameter adjustments and strategy optimization, it can become a reliable trading system component.

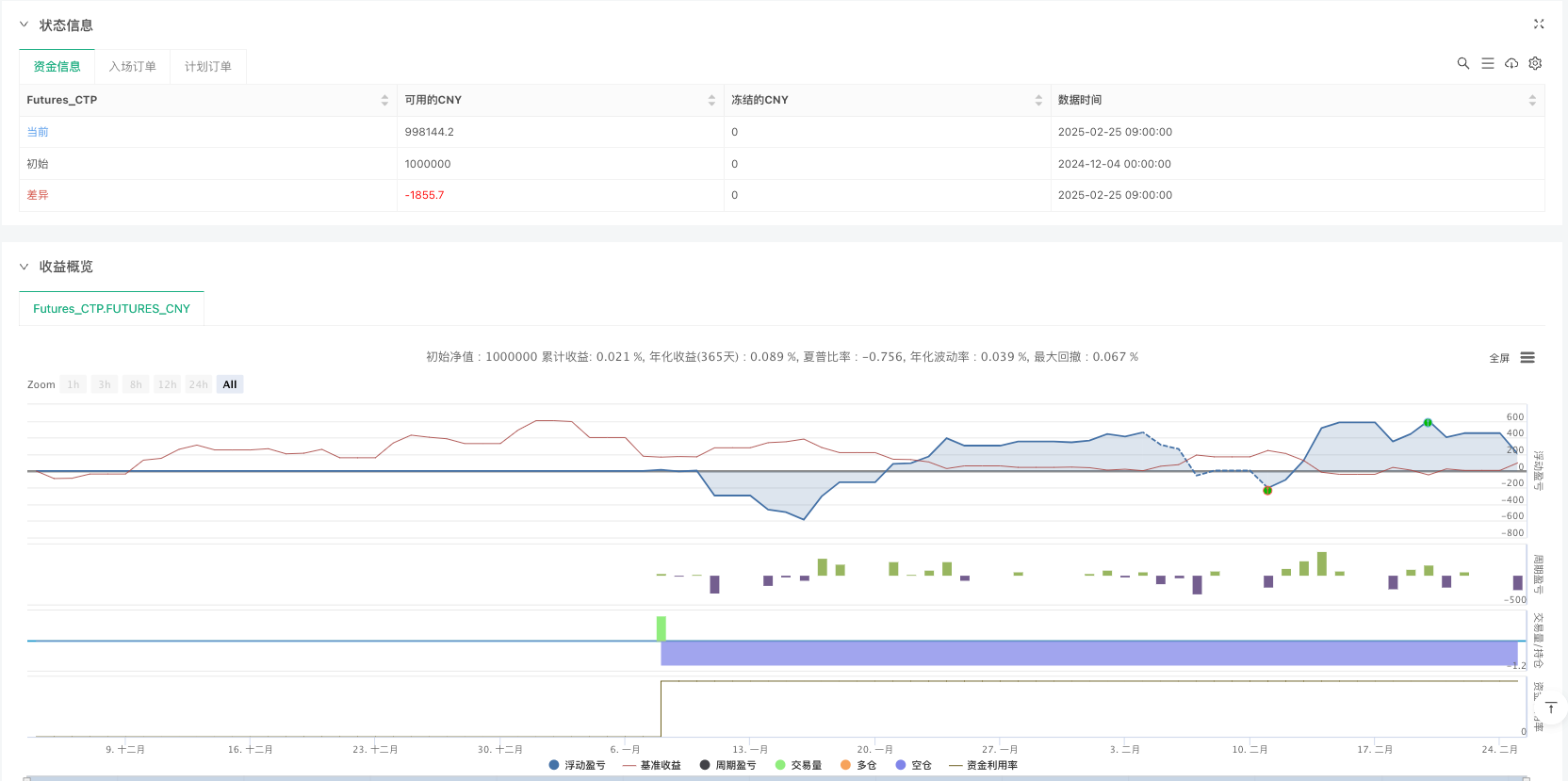

/*backtest

start: 2024-12-04 00:00:00

end: 2025-02-25 15:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

*/

//@version=5

strategy("Supertrend with 1% Target and 1% Stoploss", overlay=true)

// Input parameters

atr_length = input.int(14, title="ATR Length")

factor = input.float(3.0, title="Factor")

target_pct = input.float(1.0, title="Target Percentage", minval=0.1) / 100

stoploss_pct = input.float(1.0, title="Stop Loss Percentage", minval=0.1) / 100

// Supertrend calculation

[supertrend, direction] = ta.supertrend(factor, atr_length)

// Plot the Supertrend line

plot(supertrend, color=color.blue, linewidth=2, title="Supertrend")

// Long and Short conditions

long_condition = ta.crossover(close, supertrend)

short_condition = ta.crossunder(close, supertrend)

// Calculate stop loss and take profit levels

long_stop_loss = close * (1 - stoploss_pct)

long_take_profit = close * (1 + target_pct)

short_stop_loss = close * (1 + stoploss_pct)

short_take_profit = close * (1 - target_pct)

// Long position entry

if long_condition

strategy.entry("Long", strategy.long, stop=long_stop_loss, limit=long_take_profit)

// Short position entry

if short_condition

strategy.entry("Short", strategy.short, stop=short_stop_loss, limit=short_take_profit)

// Plot stoploss and take profit levels for visual reference

plot(long_condition ? long_take_profit : na, color=color.green, style=plot.style_line, linewidth=1, title="Long Take Profit")

plot(long_condition ? long_stop_loss : na, color=color.red, style=plot.style_line, linewidth=1, title="Long Stop Loss")

plot(short_condition ? short_take_profit : na, color=color.green, style=plot.style_line, linewidth=1, title="Short Take Profit")

plot(short_condition ? short_stop_loss : na, color=color.red, style=plot.style_line, linewidth=1, title="Short Stop Loss")