Overview

The Multi-Indicator Weighted Smart Trading Strategy is a comprehensive quantitative trading system that generates trading decisions by integrating signals from multiple technical indicators with different assigned weights. This strategy combines various technical analysis tools including MACD, Stochastic RSI, EMA, Supertrend, and moving average crossovers to form a comprehensive trading framework. The system not only supports multi-level take-profit and dynamic stop-loss mechanisms but also automatically adjusts trading parameters based on market conditions, maintaining high adaptability across different market environments. This strategy is particularly suitable for medium to long-term traders, using a weight allocation system to make trading decisions more robust and reliable.

Strategy Principle

The core of this strategy lies in its weighted signal system, which generates trading signals through five different sub-strategies:

MACD Strategy: Utilizes the crossover between the MACD line and the signal line to determine market trend direction. When the MACD line crosses above the signal line, it generates a buy signal; when it crosses below, it generates a sell signal.

Stochastic RSI Strategy: Combines the advantages of RSI and stochastic indicators to monitor market overbought and oversold conditions. Buy signals are generated when the Stochastic RSI falls below the set oversold threshold, and sell signals when it rises above the overbought threshold.

EMA Overbought/Oversold Strategy: Uses EMA to identify the degree of price deviation from the mean. Buy signals occur when RSI falls below the set oversold threshold, and sell signals when it rises above the overbought threshold.

Supertrend Strategy: Sets up a price channel based on ATR multiples and determines trading direction through trend changes. Buy signals are generated when the Supertrend indicator changes from negative to positive, and sell signals when it changes from positive to negative.

Moving Average Crossover Strategy: Uses the crossover of two moving averages with different periods to determine market trends. Buy signals occur when the short-term moving average crosses above the long-term moving average, and sell signals when it crosses below.

The strategy calculates weighted sums of signals from each sub-strategy using a customizable weight system, triggering trades only when the weighted sum exceeds a set threshold. Additionally, the strategy includes a potential top/bottom identification mechanism that adjusts positions when the market may reverse.

This multi-layered signal confirmation mechanism effectively reduces false signals, improving the reliability of the trading system, while flexible parameter settings allow the strategy to adapt to different trading instruments and time periods.

Strategy Advantages

Multiple Signal Confirmation: By calculating weighted signals generated from five independent technical indicators, the strategy reduces the potential misleading effects of single indicators, improving the quality and reliability of trading signals.

Adaptive Weight System: Each sub-strategy can be assigned different weights, allowing traders to adjust the strategy’s focus based on their confidence in different indicators and historical performance, enhancing the strategy’s flexibility.

Comprehensive Risk Management: The strategy incorporates multi-layered risk control mechanisms, including stop-loss, multi-level take-profit, and dynamic stop-loss adjustment functions, ensuring rapid risk control during adverse market movements.

Automated Potential Top/Bottom Identification: Through comprehensive analysis of RSI, trading volume, and price trends, the strategy can identify potential market tops and bottoms, partially closing positions at appropriate times to lock in profits or reduce losses.

High Customizability: Almost all parameters can be adjusted, including indicator calculation periods, weight values, take-profit and stop-loss percentages, allowing traders to optimize the strategy according to personal style and different market conditions.

Built-in Delay Mechanism: To avoid entering trades too early or based on noise signals, the strategy employs a delay confirmation mechanism, ensuring that only persistent signals trigger trades, reducing the impact of short-term fluctuations.

Time Filtering Function: The strategy allows setting start and end dates for trading, enabling traders to backtest performance for specific time periods based on historical data or avoid known periods of abnormal market volatility.

Strategy Risks

Parameter Over-Optimization Risk: With numerous parameters, there is a risk of overfitting historical data, potentially leading to poor performance in live trading. The solution is to backtest across multiple time periods and instruments, adopt relatively robust parameter settings, and avoid excessive optimization for specific historical data.

Market Condition Change Risk: The strategy’s performance may vary between trending and ranging markets, and sudden changes in market state can lead to decreased effectiveness. The solution is to introduce a market environment recognition mechanism that adjusts parameters or pauses trading under different market conditions.

Signal Conflict Risk: Using multiple indicators simultaneously may produce contradictory signals, leading to confused decision-making. The solution is to set reasonable weights for each indicator, emphasize more reliable indicators, and ensure appropriate signal threshold settings to reduce conflict probability.

Improper Fund Management Risk: Despite the strategy’s stop-loss mechanisms, unreasonable fund management can still lead to rapid depletion of capital. The solution is to strictly control the proportion of funds for each trade, ensuring that the maximum risk per trade is within an acceptable range.

Technical Failure Risk: Automated trading systems may face technical issues such as network interruptions and data delays. The solution is to set up manual intervention mechanisms, regularly monitor system operation status, and promptly address abnormal situations.

Strategy Optimization Directions

Incorporate Market Environment Filter: Develop an indicator that can identify whether the current market is trending or ranging, dynamically adjusting the weights of each sub-strategy based on market state, strengthening trend-following strategies in trending markets and oscillating strategies in ranging markets.

Introduce Machine Learning Optimization: Utilize machine learning techniques to automatically adjust parameters and weights of various indicators, enabling the strategy to continuously learn and adapt based on the latest market data, improving its dynamic adaptation capability.

Add Volume Analysis: Use volume changes as additional confirmation signals, executing trades only when supported by expected volume, increasing the credibility of signals.

Optimize Potential Top/Bottom Identification Algorithm: Improve the existing top/bottom identification logic by adding more confirmation factors, such as price patterns and multi-period confirmation, enhancing identification accuracy.

Add Sentiment Indicators: Integrate market sentiment indicators, such as the VIX (fear index) and the call-put ratio, to adjust trading strategies or pause trading during extreme market sentiment, avoiding excessive trading during high volatility periods.

Develop Dynamic Take-Profit and Stop-Loss Mechanisms: Automatically adjust take-profit and stop-loss levels based on market volatility, widening stop-loss ranges in high-volatility markets and tightening them in low-volatility markets, making risk management more flexible and effective.

Time Period Optimization: Add multi-timeframe analysis functionality, requiring signal confirmation from both higher and lower timeframes simultaneously, reducing false breakouts and false signals.

Summary

The Multi-Indicator Weighted Smart Trading Strategy constructs a comprehensive and flexible trading system by integrating various technical analysis tools with different weights. This strategy not only features multiple signal confirmation, an adaptive weight system, and comprehensive risk management functions but also includes an automated potential top/bottom identification mechanism, demonstrating strong adaptability in complex and changing market environments.

Although there are potential risks such as parameter over-optimization, market condition changes, and signal conflicts, these risks can be effectively controlled through reasonable parameter settings, market environment recognition, and strict fund management. Future optimization directions include incorporating market environment filters, introducing machine learning techniques, enhancing volume analysis, and optimizing potential top/bottom identification algorithms. These improvements will further enhance the strategy’s stability and profitability.

For investors seeking systematic trading methods, this multi-indicator weighted smart trading strategy provides a framework worth considering. It not only reduces the impact of emotional factors on trading decisions but also continuously optimizes trading performance through a data-driven approach. When implementing this strategy, it is recommended to start with conservative parameter settings, gradually adjust and closely monitor strategy performance to find the configuration that best suits personal risk preferences and market conditions.

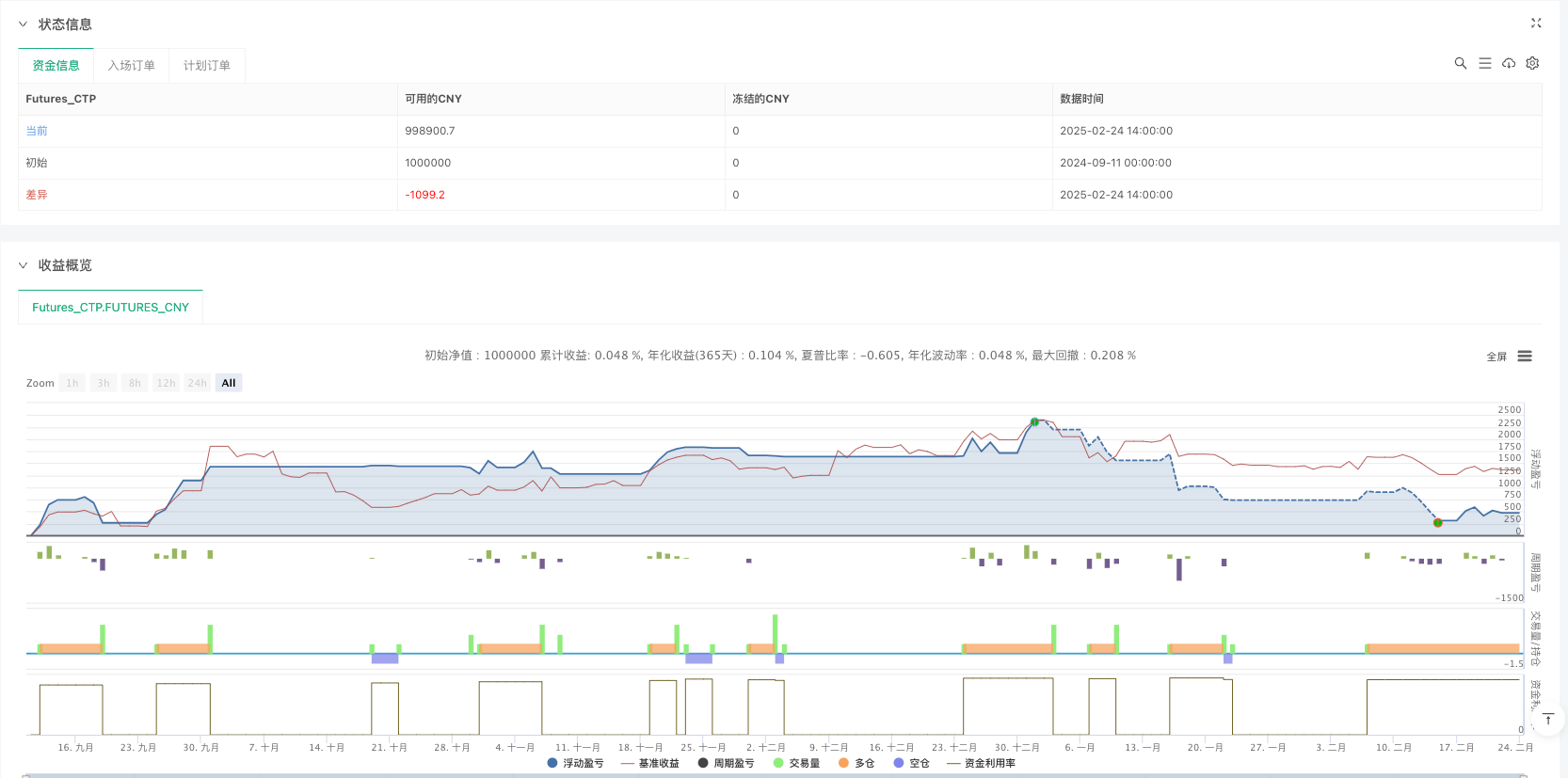

/*backtest

start: 2024-09-11 00:00:00

end: 2025-02-24 15:00:00

period: 1h

basePeriod: 1m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

*/

// **********************************************************************************************************************************************************************************************************************************************************************

// Last update: 08/03/2022

// *************************************************************************************************************************************************************************************************************************************************************************

//@version=5

strategy(title='Smart trading', overlay=true)

// *************************************************************************************************************************************************************************************************************************************************************************

// COMMENTS

// *************************************************************************************************************************************************************************************************************************************************************************

chat_id = input("-1001587924564",'Chat ID Telegram')

procent_stop = input.float(1.0,'Процент стоп')

procent_teik = input.float(4.0,'Процент TP4 ')

// *************************************************************************************************************************************************************************************************************************************************************************

// INPUTS

// *************************************************************************************************************************************************************************************************************************************************************************

// * Type trading

allow_longs = input.bool(true, 'Только лонги', group='Trading type')

allow_shorts = input.bool(true, 'Только шорты', group='Trading type')

// * Datastamp

from_day = input.int(1, 'From Day', minval=1, maxval=31, group='DataStamp')

from_month = input.int(1, 'From Month', minval=1, maxval=12, group='DataStamp')

from_year = input.int(2021, 'From Year', minval=1980, maxval=9999, group='DataStamp')

to_day = input.int(1, 'To Day', minval=1, maxval=31, group='DataStamp')

to_month = input.int(1, 'To Month', minval=1, maxval=12, group='DataStamp')

to_year = input.int(9999, 'To Year', minval=2017, maxval=9999, group='DataStamp')

// * Stop loss

stoploss = input.bool(true, 'Стоп лосс в стратегии', group='Stop loss')

movestoploss = input.string('TP-2', 'Перенос стопа', options=['None', 'Percentage', 'TP-1', 'TP-2', 'TP-3'], group='Stop loss')

movestoploss_entry = input.bool(false, 'Перенос стопа на твх', group='Stop loss')

stoploss_perc = input.float(6.0, 'Стоп лосс в %', minval=0, maxval=100, group='Stop loss') * 0.01

move_stoploss_factor = input.float(20.0, 'Фактор переноса стопа в %', group='Stop loss') * 0.01 + 1

stop_source = input.source(hl2, 'Stop Source', group='Stop loss')

// * Take profits

take_profits = input.bool(true, 'Тейк профит в стратегии', group='Take Profits')

// retrade= input.bool(false, 'Retrade', group='Take Profits')

MAX_TP = input.int(6, 'Кол-во TP', minval=1, maxval=10, group='Take Profits')

long_profit_perc = input.float(6.8, 'Long - TP в % каждый', minval=0.0, maxval=999, step=1, group='Take Profits') * 0.01

long_profit_qty = input.float(15, 'Long - TP в % от твх', minval=0.0, maxval=100, step=1, group='Take Profits')

short_profit_perc = input.float(13, 'Short - TP в % каждый', minval=0.0, maxval=999, step=1, group='Take Profits') * 0.01

short_profit_qty = input.float(10, 'Short - TP в % от твх', minval=0.0, maxval=100, step=1, group='Take Profits')

// * Delays

delay_macd = input.int(1, 'Candles delay MACD', minval=1, group='Delays')

delay_srsi = input.int(2, 'Candles delay RSI', minval=1, group='Delays')

delay_rsi = input.int(2, 'Candles delay EMA', minval=1, group='Delays')

delay_super = input.int(1, 'Candles delay Supertrend', minval=1, group='Delays')

delay_cross = input.int(1, 'Candles delay MA', minval=1, group='Delays')

delay_exit = input.int(7, 'Candles delay exit', minval=1, group='Delays')

// * Inputs Smart strategies

str_0 = input.bool(true, 'Strategy 0: Weighted Strategy', group='Weights')

weight_trigger = input.int(2, 'Smart Signal entry [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str1 = input.int(1, 'Smart Strategy 1 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str2 = input.int(1, 'Smart Strategy 2 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str3 = input.int(1, 'Smart Strategy 3 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str4 = input.int(1, 'Smart Strategy 4 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str5 = input.int(1, 'Smart Strategy 5 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

// * Inputs strategy 1: MACD

str_1 = input.bool(true, 'Strategy 1: MACD', group='Strategy 1: MACD')

MA1_period_1 = input.int(16, 'MA 1', minval=1, maxval=9999, step=1, group='Strategy 1: MACD')

MA1_type_1 = input.string('EMA', 'MA1 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 1: MACD')

MA1_source_1 = input.source(hl2, 'MA1 Source', group='Strategy 1: MACD')

MA2_period_1 = input.int(36, 'MA 2', minval=1, maxval=9999, step=1, group='Strategy 1: MACD')

MA2_type_1 = input.string('EMA', 'MA2 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 1: MACD')

MA2_source_1 = input.source(high, 'MA2 Source', group='Strategy 1: MACD')

// * Inputs strategy 2: RSI oversold/overbought

str_2 = input.bool(true, 'Strategy 2: RSI', group='Strategy 2: RSI')

long_RSI = input.float(70, 'Exit RSI Long (%)', minval=0.0, step=1, group='Strategy 2: RSI')

short_RSI = input.float(27, 'Exit RSI Short (%)', minval=0.0, step=1, group='Strategy 2: RSI')

length_RSI = input.int(14, 'RSI Length', group='Strategy 2: RSI')

length_stoch = input.int(14, 'RSI Stochastic', group='Strategy 2: RSI')

smoothK = input.int(3, 'Smooth', group='Strategy 2: RSI')

// * Inputs strategy 3: EMA oversold/overbought

str_3 = input.bool(true, 'Strategy 3: RSI', group='Strategy 3: RSI')

long_RSI2 = input.float(77, 'Exit EMA Long', minval=0.0, step=1, group='Strategy 3: RSI')

short_RSI2 = input.float(30, 'Exit EMA Short', minval=0.0, step=1, group='Strategy 3: RSI')

// * Inputs strategy 4: Supertrend

str_4 = input.bool(true, 'Strategy 4: Supertrend', group='Strategy 4: Supertrend')

periods_4 = input.int(2, 'ATR Period', group='Strategy 4: Supertrend')

source_4 = input.source(hl2, 'Source', group='Strategy 4: Supertrend')

multiplier = input.float(2.4, 'ATR Multiplier', step=0.1, group='Strategy 4: Supertrend')

change_ATR = input.bool(true, 'Change ATR Calculation Method ?', group='Strategy 4: Supertrend')

// * Inputs strategy 5: MA

str_5 = input.bool(true, 'Strategy 5: MA', group='Strategy 5: MA')

MA1_period_5 = input.int(46, 'MA 1', minval=1, maxval=9999, step=1, group='Strategy 5: MA')

MA1_type_5 = input.string('EMA', 'MA1 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 5: MA')

MA1_source_5 = input.source(close, 'MA1 Source', group='Strategy 5: MA')

MA2_period_5 = input.int(82, 'MA 2', minval=1, maxval=9999, step=1, group='Strategy 5: MA')

MA2_type_5 = input.string('EMA', 'MA2 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 5: MA')

MA2_source_5 = input.source(close, 'MA2 Source', group='Strategy 5: MA')

// * Inputs Potential TOP/BOTTOM

str_6 = input.bool(false, 'Потенциальные ордера long/short', group='Potential TOP/BOTTOM')

top_qty = input.float(30, 'Лонг закрыть (%) из оставшейся позиции', minval=0.0, maxval=100, step=1, group='Potential TOP/BOTTOM')

bottom_qty = input.float(30, 'Шорт закрыть (%) из оставшейся позиции', minval=0.0, maxval=100, step=1, group='Potential TOP/BOTTOM')

source_6_top = input.source(close, 'TP-TOP на предыдущий', group='Potential TOP/BOTTOM')

source_6_bottom = input.source(close, 'TP-BOTTOM на предыдущий', group='Potential TOP/BOTTOM')

long_trail_perc = input.float(150, 'Объем Long (%)', minval=0.0, step=1, group='Potential TOP/BOTTOM') * 0.01

short_trail_perc = input.float(150, 'Объем Short (%)', minval=0.0, step=1, group='Potential TOP/BOTTOM') * 0.01

// * Flags

FLAG_SIGNALS = input.bool(true, 'Show Buy/Sell Signals ?', group='Miscellaneous')

FLAG_SHADOWS = input.bool(true, 'Show shadows satisfied strategies ?', group='Miscellaneous')

// * Alarms

alarm_label_long = input.string('Buy', 'Label open long', group='Basic alarm system')

alarm_label_short = input.string('Sell', 'Label open short', group='Basic alarm system')

alarm_label_close_long = input.string('Close long', 'Label close long', group='Basic alarm system')

alarm_label_close_short = input.string('Close short', 'Label close short', group='Basic alarm system')

alarm_label_TP_long = input.string('TP long', 'Label Take Profit long', group='Basic alarm system')

alarm_label_TP_short = input.string('TP short', 'Label Take Profit short', group='Basic alarm system')

alarm_label_SL = input.string('SL', 'Label Stop-Loss', group='Basic alarm system')

// *************************************************************************************************************************************************************************************************************************************************************************

// ABBREVIATIONS

// *************************************************************************************************************************************************************************************************************************************************************************

// TP: Take profits

// SL: Stop-Loss

// *************************************************************************************************************************************************************************************************************************************************************************

// GLOBAL VARIABLES

// *************************************************************************************************************************************************************************************************************************************************************************

start = timestamp(from_year, from_month, from_day, 00, 00) // backtest start window

end = timestamp(to_year, to_month, to_day, 23, 59)// backtest finish window

var FLAG_FIRST = false

var price_stop_long = 0.

var price_stop_short = 0.

var profit_qty = 0. // Quantity to close per TP from open position

var profit_perc = 0. // Percentage to take profits since open position or last TP

var nextTP = 0. // Next target to take profits

var since_entry = 0 // Number of bars since open last postion

var since_close = 0 // Number of bars since close or TP/STOP last position

// * Compute profit quantity and profit percentage

if strategy.position_size > 0

profit_qty := long_profit_qty

profit_perc := long_profit_perc

else if strategy.position_size < 0

profit_qty := short_profit_qty

profit_perc := short_profit_perc

else

nextTP := 0. // Next Take Profit target (out of market)

// *************************************************************************************************************************************************************************************************************************************************************************

// FUNCTIONS

// *************************************************************************************************************************************************************************************************************************************************************************

// * MA type

// *************************************************************************************************************************************************************************************************************************************************************************

ma(MAType, MASource, MAPeriod) =>

if MAType == 'SMA'

ta.sma(MASource, MAPeriod)

else if MAType == 'EMA'

ta.ema(MASource, MAPeriod)

else if MAType == 'WMA'

ta.wma(MASource, MAPeriod)

else if MAType == 'RMA'

ta.rma(MASource, MAPeriod)

else if MAType == 'HMA'

ta.wma(2 * ta.wma(MASource, MAPeriod / 2) - ta.wma(MASource, MAPeriod), math.round(math.sqrt(MAPeriod)))

else if MAType == 'DEMA'

e = ta.ema(MASource, MAPeriod)

2 * e - ta.ema(e, MAPeriod)

else if MAType == 'TEMA'

e = ta.ema(MASource, MAPeriod)

3 * (e - ta.ema(e, MAPeriod)) + ta.ema(ta.ema(e, MAPeriod), MAPeriod)

else if MAType == 'VWMA'

ta.vwma(MASource, MAPeriod)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Number strategies

// *************************************************************************************************************************************************************************************************************************************************************************

n_strategies() =>

var result = 0.

if str_1

result := 1.

if str_2

result += 1.

if str_3

result += 1.

if str_4

result += 1.

if str_5

result += 1.

// *************************************************************************************************************************************************************************************************************************************************************************

// * Price take profit

// *************************************************************************************************************************************************************************************************************************************************************************

price_takeProfit(percentage, N) =>

if strategy.position_size > 0

strategy.position_avg_price * (1 + N * percentage)

else

strategy.position_avg_price * (1 - N * percentage)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Weigthed values

// *************************************************************************************************************************************************************************************************************************************************************************

weight_values(signal) =>

if signal

weight = 1.0

else

weight = 0.

// *************************************************************************************************************************************************************************************************************************************************************************

// * Weigthed total

// *************************************************************************************************************************************************************************************************************************************************************************

weight_total(signal1, signal2, signal3, signal4, signal5) =>

weight_str1 * weight_values(signal1) + weight_str2 * weight_values(signal2) + weight_str3 * weight_values(signal3) + weight_str4 * weight_values(signal4) + weight_str5 * weight_values(signal5)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Set alert TP message

// *************************************************************************************************************************************************************************************************************************************************************************

set_alarm_label_TP() =>

if strategy.position_size > 0

alarm_label_TP_long

else if strategy.position_size < 0

alarm_label_TP_short

// *************************************************************************************************************************************************************************************************************************************************************************

// * Color

// *************************************************************************************************************************************************************************************************************************************************************************

colors(type, value=0) =>

switch str.lower(type)

'buy'=> color.new(color.aqua, value)

'sell' => color.new(color.gray, value)

'TP' => color.new(color.aqua, value)

'SL' => color.new(color.gray, value)

'signal' => color.new(color.orange, value)

'profit' => color.new(color.teal, value)

'loss' => color.new(color.red, value)

'info' => color.new(color.white, value)

'highlights' => color.new(color.orange, value)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Bar since last entry

// *************************************************************************************************************************************************************************************************************************************************************************

bars_since_entry() =>

bar_index - strategy.opentrades.entry_bar_index(0)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Bar since close or TP/STOP

// *************************************************************************************************************************************************************************************************************************************************************************

bars_since_close() =>

ta.barssince(ta.change(strategy.closedtrades))

// *************************************************************************************************************************************************************************************************************************************************************************

// ADDITIONAL GLOBAL VARIABLES

// *************************************************************************************************************************************************************************************************************************************************************************

// * Compute time since last entry and last close/TP position

since_entry := bars_since_entry()

since_close := bars_since_close()

if strategy.opentrades == 0

since_entry := delay_exit

if strategy.closedtrades == 0

since_close := delay_exit

// *************************************************************************************************************************************************************************************************************************************************************************

// STRATEGIES

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 1: MACD

// *************************************************************************************************************************************************************************************************************************************************************************

MA1 = ma(MA1_type_1, MA1_source_1, MA1_period_1)

MA2 = ma(MA2_type_1, MA2_source_1, MA2_period_1)

MACD = MA1 - MA2

signal = ma('SMA', MACD, 9)

trend= MACD - signal

long = MACD > signal

short = MACD < signal

proportion = math.abs(MACD / signal)

// * Conditions

long_signal1 = long and long[delay_macd - 1] and not long[delay_macd]

short_signal1 = short and short[delay_macd - 1] and not short[delay_macd]

close_long1 = short and not long[delay_macd]

close_short1 = long and not short[delay_macd]

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 2: STOCH RSI

// *************************************************************************************************************************************************************************************************************************************************************************

rsi = ta.rsi(close, length_RSI)

srsi = ta.stoch(rsi, rsi, rsi, length_stoch)

k = ma('SMA', srsi, smoothK)

isRsiOB = k >= long_RSI

isRsiOS = k <= short_RSI

// * Conditions

long_signal2 = isRsiOS[delay_srsi] and not isRsiOB and since_entry >= delay_exit and since_close >= delay_exit

short_signal2 = isRsiOB[delay_srsi] and not isRsiOS and since_entry >= delay_exit and since_close >= delay_exit

close_long2 = short_signal2

close_short2 = long_signal2

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 3: RSI

// *************************************************************************************************************************************************************************************************************************************************************************

isRsiOB2 = rsi >= long_RSI2

isRsiOS2 = rsi <= short_RSI2

// * Conditions

long_signal3 = isRsiOS2[delay_rsi] and not isRsiOB2 and since_entry >= delay_exit and since_close >= delay_exit

short_signal3 = isRsiOB2[delay_rsi] and not isRsiOS2 and since_entry >= delay_exit and since_close >= delay_exit

close_long3 = short_signal3

close_short3 = long_signal3

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 4: SUPERTREND

// *************************************************************************************************************************************************************************************************************************************************************************

atr2 = ma('SMA', ta.tr, periods_4)

atr = change_ATR ? ta.atr(periods_4) : atr2

up = source_4 - multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = source_4 + multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend := 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// * Conditions

long4 = trend == 1

short4 = trend == -1

long_signal4 = trend == 1 and trend[delay_super - 1] == 1 and trend[delay_super] == -1

short_signal4 = trend == -1 and trend[delay_super - 1] == -1 and trend[delay_super] == 1

changeCond = trend != trend[1]

close_long4 = short_signal4

close_short4 = short_signal4

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 5: MA CROSS

// *************************************************************************************************************************************************************************************************************************************************************************

MA12 = ma(MA1_type_5, MA1_source_5, MA1_period_5)

MA22 = ma(MA2_type_5, MA2_source_5, MA2_period_5)

long5 = MA12 > MA22

short5 = MA12 < MA22

// * Conditions

long_signal5 = long5 and long5[delay_cross - 1] and not long5[delay_cross]

short_signal5 = short5 and short5[delay_cross - 1] and not short5[delay_cross]

close_long5 = short5 and not long5[delay_cross]

close_short5 = long5 and not short5[delay_cross]

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 6: POTENTIAL TOP/BOTTOM

// *************************************************************************************************************************************************************************************************************************************************************************

// * Combination RSI, Stoch RSI, MACD, volume, and weighted-strategy to detect potential TOP/BOTTOMS areas

volumeRSI_condition = volume[2] > volume[3] and volume[2] > volume[4] and volume[2] > volume[5]

condition_OB1 = isRsiOB2 and (isRsiOB or volume < ma('SMA', volume, 20) / 2) and volumeRSI_condition

condition_OS1 = isRsiOS2 and (isRsiOS or volume < ma('SMA', volume, 20) / 2) and volumeRSI_condition

condition_OB2 = volume[2] / volume[1] > (1.0 + long_trail_perc) and isRsiOB and volumeRSI_condition

condition_OS2 = volume[2] / volume[1] > (1.0 + short_trail_perc) and isRsiOS and volumeRSI_condition

condition_OB3 = weight_total(MACD < signal, isRsiOB, isRsiOB2, short4, short5) >= weight_trigger

condition_OS3 = weight_total(MACD > signal, isRsiOS, isRsiOS2, long4, long5) >= weight_trigger

condition_OB = (condition_OB1 or condition_OB2)

condition_OS = (condition_OS1 or condition_OS2)

condition_OB_several = condition_OB[1] and condition_OB[2] or condition_OB[1] and condition_OB[3] or condition_OB[1] and condition_OB[4] or condition_OB[1] and condition_OB[5] or condition_OB[1] and condition_OB[6] or condition_OB[1] and condition_OB[7]

condition_OS_several = condition_OS[1] and condition_OS[2] or condition_OS[1] and condition_OS[3] or condition_OS[1] and condition_OS[4] or condition_OS[1] and condition_OS[5] or condition_OS[1] and condition_OS[6] or condition_OS[1] and condition_OS[7]

// *************************************************************************************************************************************************************************************************************************************************************************

// STRATEGY ENTRIES AND EXITS

// *************************************************************************************************************************************************************************************************************************************************************************

long_SL = close - ((close / 100) * procent_stop)

long_OP = close

long_TP_1 = close + ((close / 100) * (procent_teik * 1.1))

long_TP_2 = close + ((close / 100) * (procent_teik * 1.8))

long_TP_3 = close + ((close / 100) * (procent_teik * 2.8))

long_TP_4 = close + ((close / 100) * (procent_teik * 4.5))

short_SL = close + ((close / 100) * procent_stop)

short_OP = close

short_TP_1 = close - ((close / 100) * (procent_teik * 1.1))

short_TP_2 = close - ((close / 100) * (procent_teik * 1.8))

short_TP_3 = close - ((close / 100) * (procent_teik * 2.8))

short_TP_4 = close - ((close / 100) * (procent_teik * 4.5))

if time >= start and time <= end

// ***************************************************************************************************************************************************************************

// * Set Entries

// ***************************************************************************************************************************************************************************

if str_0

if not str_1

weight_str1 := 0

if not str_2

weight_str2 := 0

if not str_3

weight_str3 := 0

if not str_4

weight_str4 := 0

if not str_5

weight_str5 := 0

if allow_shorts == true

w_total = weight_total(short_signal1, short_signal2, short_signal3, short_signal4, short_signal5)

if w_total >= weight_trigger

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

strategy.entry('Short', strategy.short)

if allow_longs == true

w_total = weight_total(long_signal1, long_signal2, long_signal3, long_signal4, long_signal5)

if w_total >= weight_trigger

strategy.entry('Long', strategy.long)

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

else

if allow_shorts == true

if str_1

strategy.entry('Short', strategy.short, when=short_signal1)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_2

strategy.entry('Short', strategy.short, when=short_signal2)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_3

strategy.entry('Short', strategy.short, when=short_signal3)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_4

strategy.entry('Short', strategy.short, when=short_signal4)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_5

strategy.entry('Short', strategy.short, when=short_signal5)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if allow_longs == true

if str_1

strategy.entry('Long', strategy.long, when=long_signal1)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_2

strategy.entry('Long', strategy.long, when=long_signal2)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_3

strategy.entry('Long', strategy.long, when=long_signal3)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_4

strategy.entry('Long', strategy.long, when=long_signal4)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_5

strategy.entry('Long', strategy.long, when=long_signal5)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

// ***************************************************************************************************************************************************************************

// * Set Take Profits

// ***************************************************************************************************************************************************************************

if strategy.position_size != 0 and take_profits and since_entry == 0

for i = 1 to MAX_TP

id = 'TP ' + str.tostring(i)

strategy.exit(id=id, limit=price_takeProfit(profit_perc, i), qty_percent=profit_qty, comment=id)

// ***************************************************************************************************************************************************************************

// * Set Stop loss

// ***************************************************************************************************************************************************************************

if strategy.position_size > 0

if since_close == 0

if high > price_takeProfit(profit_perc, 6) and MAX_TP >= 6

n = 6

nextTP := na

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_long := price_takeProfit(profit_perc, n-3)

else if high > price_takeProfit(profit_perc, 5) and MAX_TP >= 5

n = 5

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_long := price_takeProfit(profit_perc, n-3)

else if high > price_takeProfit(profit_perc, 4) and MAX_TP >= 4

n = 4

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_long := price_takeProfit(profit_perc, n-3)

else if high > price_takeProfit(profit_perc, 3) and MAX_TP >= 3

n = 3

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if high > price_takeProfit(profit_perc, 2) and MAX_TP >= 2

n = 2

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if high > price_takeProfit(profit_perc, 1) and MAX_TP >= 1

n = 1

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_long := strategy.position_avg_price

if since_entry == 0

n = 0

nextTP := price_takeProfit(profit_perc, n + 1)

price_stop_long := strategy.position_avg_price * (1 - stoploss_perc)

if strategy.position_size < 0

if since_close == 0

if low < price_takeProfit(profit_perc, 6) and MAX_TP >= 6

n = 6

nextTP := na

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_short := price_takeProfit(profit_perc, n-3)

else if low < price_takeProfit(profit_perc, 5) and MAX_TP >= 5

n = 5

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_short := price_takeProfit(profit_perc, n-3)

else if low < price_takeProfit(profit_perc, 4) and MAX_TP >= 4

n = 4

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_short := price_takeProfit(profit_perc, n-3)

else if low < price_takeProfit(profit_perc, 3) and MAX_TP >= 3

n = 3

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if low < price_takeProfit(profit_perc, 2) and MAX_TP >= 2

n = 2

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if low < price_takeProfit(profit_perc, 1) and MAX_TP >= 1

n = 1

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_short := strategy.position_avg_price

if since_entry == 0

n = 0

nextTP := price_takeProfit(profit_perc, n + 1)

price_stop_short := strategy.position_avg_price * (1 + stoploss_perc)

// ***************************************************************************************************************************************************************************

// * Set Exits

// ***************************************************************************************************************************************************************************

if allow_longs == true and allow_shorts == false

if str_0

w_total = weight_total(short_signal1, short_signal2, short_signal3, short_signal4, short_signal5)

strategy.close('Long', when=w_total>=weight_trigger, qty_percent=100, comment='SHORT')

else

if str_1

strategy.close('Long', when=close_long1, qty_percent=100, comment='SHORT')

if str_2

strategy.close('Long', when=close_long2, qty_percent=100, comment='SHORT')

if str_3

strategy.close('Long', when=close_long3, qty_percent=100, comment='SHORT')

if str_4

strategy.close('Long', when=close_long4, qty_percent=100, comment='SHORT')

if str_5

strategy.close('Long', when=close_long5, qty_percent=100, comment='SHORT')

if allow_longs == false and allow_shorts == true

if str_0

w_total = weight_total(long_signal1, long_signal2, long_signal3, long_signal4, long_signal5)

strategy.close('Short', when=w_total>=weight_trigger, qty_percent=100, comment='LONG')

else

if str_1

strategy.close('Short', when=close_long1, qty_percent=100, comment='LONG')

if str_2

strategy.close('Short', when=close_long2, qty_percent=100, comment='LONG')

if str_3

strategy.close('Short', when=close_long3, qty_percent=100, comment='LONG')

if str_4

strategy.close('Short', when=close_long4, qty_percent=100, comment='LONG')

if str_5

strategy.close('Short', when=close_long5, qty_percent=100, comment='LONG')

if allow_shorts == true and strategy.position_size < 0 and stoploss and since_entry > 0

strategy.close('Short', when=stop_source >= price_stop_short, qty_percent=100, comment='STOP')

if str_6

if top_qty == 100

strategy.close('Short', when=condition_OS_several, qty_percent=bottom_qty, comment='STOP')

else

strategy.exit('Short', when=condition_OS_several, limit=source_6_bottom[1], qty_percent=bottom_qty, comment='TP-B')

if allow_longs == true and strategy.position_size > 0 and stoploss and since_entry > 0

strategy.close('Long', when=stop_source <= price_stop_long, qty_percent=100, comment='STOP')

if str_6

if top_qty == 100

strategy.close('Long', when=condition_OB_several, qty_percent=top_qty, comment='STOP')

else

strategy.exit('Long', when=condition_OB_several, limit=source_6_top[1], qty_percent=top_qty, comment='TP-T')

// ***********************************************************************************************************************************************************************************************************************************************************************************

// * Data window - debugging

// *************************************************************************************************************************************************************************************************************************************************************************

price_stop = strategy.position_size > 0 ? price_stop_long : price_stop_short

// *************************************************************************************************************************************************************************************************************************************************************************

// * Buy/Sell signals

// *************************************************************************************************************************************************************************************************************************************************************************

w_total_long = weight_total(long_signal1, long_signal2, long_signal3, long_signal4, long_signal5)

w_total_short = weight_total(short_signal1, short_signal2, short_signal3, short_signal4, short_signal5)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Stop loss targets

// *************************************************************************************************************************************************************************************************************************************************************************

plot(series=(strategy.position_size > 0) ? price_stop_long : na, color=color.gray, style=plot.style_cross, linewidth=2, transp=30, title="Long Stop Loss")

plot(series=(strategy.position_size < 0) ? price_stop_short : na, color=color.gray, style=plot.style_cross, linewidth=2, transp=30, title="Short Stop Loss")

// *************************************************************************************************************************************************************************************************************************************************************************

// * TP targets

// *************************************************************************************************************************************************************************************************************************************************************************

plot(strategy.position_size > 0 or strategy.position_size < 0 ? nextTP : na, color=color.aqua, style=plot.style_cross, linewidth=2, transp=30, title="Next TP")

// *************************************************************************************************************************************************************************************************************************************************************************